The Future of Wealth Management: Transformation and Innovation

Wealth Management

JUNE 11, 2025

Brent Brodeski discusses how AI and fintech advancements are transforming wealth management, urging RIAs to adapt and seize value creation opportunities.

Management Related Topics

Management Related Topics

Wealth Management

JUNE 11, 2025

Brent Brodeski discusses how AI and fintech advancements are transforming wealth management, urging RIAs to adapt and seize value creation opportunities.

Wealth Management

MAY 27, 2025

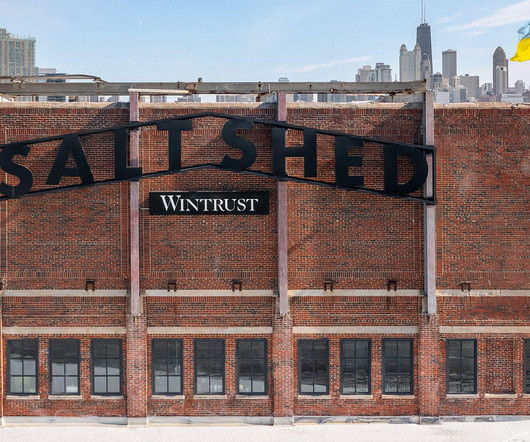

Ritholtz Wealth Management relocates its Chicago office to The Salt Shed, emphasizing the importance of physical workspace in attracting talent and fostering collaboration.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 10, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Wealth Management EDGE 2025 Industry News & Trends Scenes From Day 1 of Wealth Management EDGE 2025 Scenes From Day 1 of Wealth Management EDGE (..)

Wealth Management

JUNE 10, 2025

The Wealth Management EDGE conference kicked off at The Boca Raton resort with workshop panels focused on alternative investments, artificial intelligence and high net worth clients.

Advertiser: G-P

This eBook offers the top five business benefits to building a remote, global team, what to expect when handling the logistics of hiring and managing people around the world, and strategies for attracting, engaging, and retaining top talent.

Wealth Management

JUNE 11, 2025

Allocating to Alternatives workshops at Wealth Management EDGE confirmed that evergreen funds have become the private markets investment wrapper of choice for RIAs.

Wealth Management

JUNE 25, 2025

Modera Wealth Management's Tom Orecchio discusses the evolving dynamics and secrets to building a successful financial advisory firm.

Advertiser: G-P

What factors will affect growth, TA, and team management in 2021? From remote work becoming a mainstream way of doing business to talent shortages beginning to change the way companies build their teams, the global workforce will change rapidly this year.

Advertiser: G-P

What factors will affect growth, TA, and team management in 2021? From remote work becoming a mainstream way of doing business to talent shortages beginning to change the way companies build their teams, the global workforce will change rapidly this year. Download the eBook today!

Advertiser: G-P

Employer branding is a long-term strategy that helps companies manage the knowledge and perceptions of current and potential employees, convey the values and characteristics that define your organization’s culture, and promote commitment and pride in belonging to your company’s workforce on a global scale.

Advertiser: G-P

However, while this provides companies with new and exciting opportunities, it also comes with its challenges, one of which is managing employees in various countries. Remote work has opened the doors to hiring the best talent, wherever they may live.

Speaker: Duke Heninger

You’ll walk away with insights into the following: 🔍 Understand the key components of the Fractional CFO Toolkit 🛠 Breakdown of the Six and Two Systems to streamline financial management 🎯 Align financial activities with strategy using the 3S approach 🤝 Enhance the value you deliver with actionable strategies and minimum (..)

Speaker: Chandra McCormack, CPA, MBA, NACD.DC

Seasoned CFO and Board Member, Chandra McCormack, will guide you through: Best practices for accounting and operations to create a strong foundation for financial success 🏆 Building the backbone of the organization and team building with an eye to culture 🛠 Mastering the balance between managing operations and driving growth 💡 (..)

Speaker: Kim Beynon, CPA, CGMA, PMP

That’s why change management isn’t a side project—it’s the foundation. The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities.

Speaker: Marguerita Cheng - Chief Executive Officer at Blue Ocean Global Wealth

Professional money management has always seemed to be for a niche group of people when in actuality, almost everyone can benefit from this with the help of the right financial advisor. Personal finance apps vs. professional money management. The importance of fostering inclusion and belonging in money management.

Let's personalize your content