Dollars Are For Spending & Investing, Not Saving

The Big Picture

OCTOBER 20, 2023

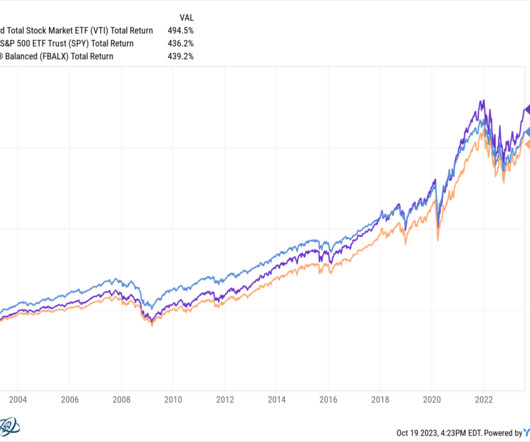

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my taxes with it, or give it away. To be more precise, I want to discuss the type of chart that reflects a fundamental misunderstanding of the nature of money, currency, spending, investing, and taxes. It does that splendidly.”

Let's personalize your content