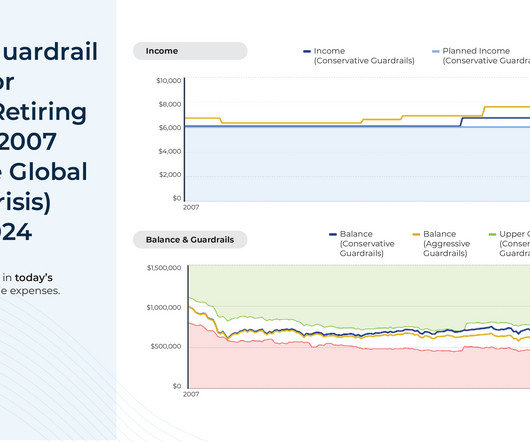

Helping Clients Grasp Abstract Retirement Income Strategies With Historical Market Visualization

Nerd's Eye View

APRIL 2, 2025

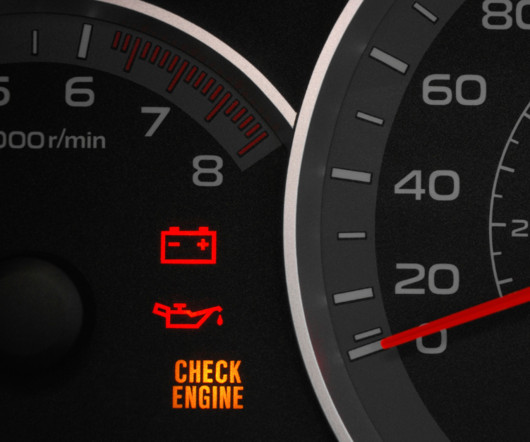

For many financial advisors, a core part of the retirement planning process involves simulating whether the client's assets will last through retirement. That emotional connection supports confidence and increases the likelihood that the client will stick with their plan and stay committed through both good markets and bad.

Let's personalize your content