Cerulli: Gen X Presents the Next Great Opportunity for Financial Advisors

Wealth Management

JULY 2, 2025

trillion annually over the next decade as part of the great wealth transfer, a new report finds.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 2, 2025

trillion annually over the next decade as part of the great wealth transfer, a new report finds.

Nerd's Eye View

NOVEMBER 25, 2024

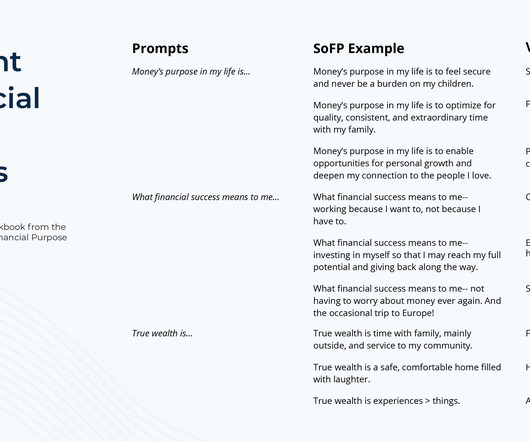

Over the past decade, a growing number of advisors have expanded into offering comprehensive financial planning services, reflecting a shift that not only helps them stand out from (increasingly commoditized) portfolio management offerings but also supports clients' broader financial goals.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JULY 24, 2025

Looking back across the decades, the foundational elements of financial planning have remained surprisingly consistent – from discovery meetings to financial plan presentations – as advisors have striven to help people make sense of their financial lives.

Nerd's Eye View

MAY 27, 2025

What's unique about Alvin, though, is how he has grown his firm by using project management software Monday.com as a central hub for financial plan presentations and efficient client task management.

Nerd's Eye View

FEBRUARY 19, 2025

Yet, while "fine" may seem like a signal of stagnation, it can also present an opportunity for the advisor to reengage the client and reinvigorate the relationship by revisiting goals and exploring new possibilities. This transition is a core element of the "Fix, Fine, Flourish" financial planning framework.

Nerd's Eye View

NOVEMBER 26, 2024

In this episode, we talk in-depth about how Kevin's firm's new hire training program ramps up through the first 6 months, starting with an initial 90-day stage that uses standardized case studies to teach the firm's financial planning process and how to review and input data into the firm's systems, followed by a second 90-day stage that builds new (..)

Nerd's Eye View

FEBRUARY 4, 2025

What's unique about Cristina, though, is how her firm supports clients in the so-called "sandwich generation" by both creating a financial plan for the clients' personal financial needs and goals, and by addressing (often with a separately paid add-on financial planning engagement) the financial issues facing their aging (and frequently less financially (..)

Nerd's Eye View

APRIL 16, 2025

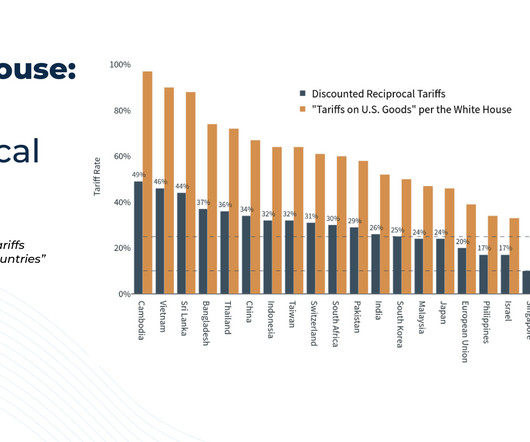

In these moments, the conversations that advisors have with their clients play a crucial role in helping clients maintain perspective, avoid emotional decisions, and stay committed to their long-term financial plans.

Nerd's Eye View

MAY 19, 2025

While some of these programs still exist, the role of an associate advisor has evolved alongside the broader financial planning profession. Others take a broader approach, giving newer advisors more opportunities to practice and build confidence across different areas of financial planning.

WiserAdvisor

JUNE 4, 2025

The financial planning industry is constantly undergoing change. Financial advisors should take these factors into account to ensure their clients receive the right experience. This article will discuss some of the most pivotal financial planning industry trends to watch out for this year.

Nerd's Eye View

NOVEMBER 6, 2024

In the early days of financial planning, serving clients often meant developing transactional relationships focused on facilitating trades and selling insurance. Over time, advisors shifted toward more analytical approaches, such as investment management and retirement planning.

Nerd's Eye View

JULY 10, 2025

Instead, advisors may find more success in leading with solving the problem that the client immediately presents, and then, over time, gradually exploring the client’s financial background as trust develops. This process of earning permission to go deeper can take months – or even years!

International College of Financial Planning

MARCH 12, 2025

Final Thoughts: The Path to Financial Security Starts Today Smart financial planning isnt about giving up the things you enjoyits about making informed decisions that align with your goals. The key is to strike a balance between enjoying the present and securing the future.

Nerd's Eye View

JUNE 18, 2025

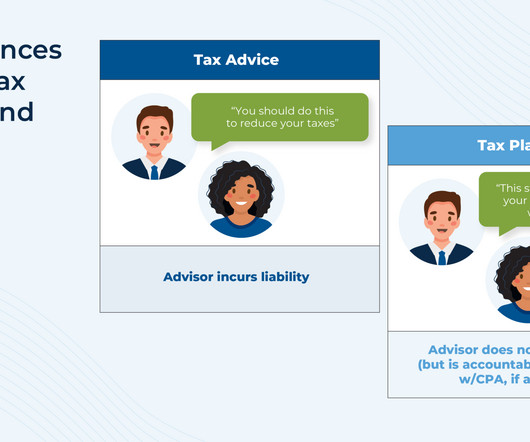

Ultimately, the rising integration of tax strategies into financial planning is a positive development that enhances the value advisors can deliver. But it also demands new considerations in how those strategies are presented.

Wealth Management

JULY 18, 2025

The first came in 2018, when he moved from Chicago to Colorado and worked at a husband-and-wife-run advisory that didn’t present a path to equity, partly because of the potential for control of the firm passing to the founders’ children. In 2023, he launched his own firm, Park Hill Financial Planning and Investment Management. “I

Wealth Management

JUNE 20, 2025

Joey Corsica & SpotMyPhotos Fast-paced and nerve-wracking for some of the presenters, the annual WealthStack Demos did not disappoint and have become a fan favorite among attendees of the Wealth Management EDGE conference held last week at The Boca Raton resort in Boca Raton, Fla. s Mili AI won.

Workable Wealth

OCTOBER 14, 2020

Financial planning can take your money game up a notch by bringing clarity, strategy, and intention to your financial life. A healthy financial plan gives you the tools to take control of your finances and start living your life with passion, purpose, and freedom. So what’s the value of a financial plan?

Wealth Management

JUNE 27, 2025

With more than 25 years of industry experience, he has set the strategic vision for the firm, which encompasses AssetMark’s platform of curated investments, technology solutions, business consulting, operations support, and acquisitions that serve the best interests of financial advisors and their investors.

Nerd's Eye View

JUNE 30, 2025

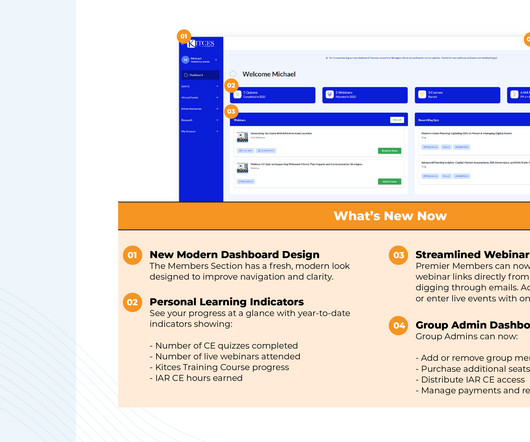

We've also announced a Save-The-Date for a second IAR CE Intensive Day later this year – on Thursday, October 30th, we'll host an "IAR P&P CE Day" (covering the Products & Practice portion of the IAR CE requirement), with a particular focus on advanced tax and retirement planning.

Discipline Funds

MARCH 10, 2025

But 20 years is a long time and most of us aren’t disciplined to let our assets sit around for 20 years because we live our lives in the present. And so the better you can match your income or returns to your expenses the more predictable you can make your financial life.

Zoe Financial

JANUARY 28, 2025

Smart Investing: Focus On Your Longterm Financial Goals Its imperative to begin the investment process with a clear idea of your goals and the time frame for your financial plan to accomplish them. Facts presented have been obtained from sources believed to be reliable. Zoe Financial does not provide legal advice.

Tobias Financial

JUNE 16, 2025

In contrast, your financial life often lacks such clear signals. Yet just like your vehicle, your financial plan benefits from regular maintenance and timely adjustments. At Tobias Financial Advisors, we view financial planning as an ongoing process designed to evolve with your life.

Don Connelly & Associates

DECEMBER 16, 2024

Whether planning for retirement, investing in volatile markets, or managing tax implications, clients are often presented with intricate information that can leave them overwhelmed, confused, and anxious, undermining their ability to make informed decisions.

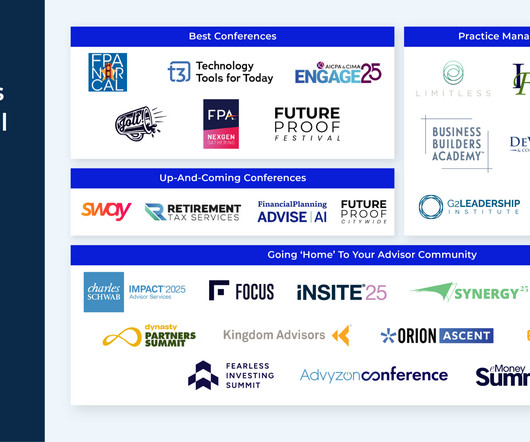

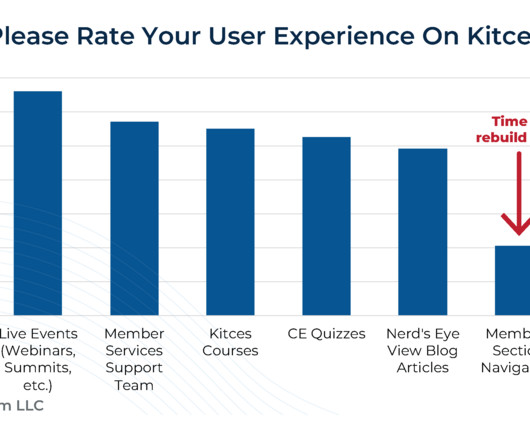

Nerd's Eye View

OCTOBER 28, 2024

Once the domain of membership associations that, especially amongst independent financial advisors, created a central space for networking and community, conferences were primarily built around professional development (i.e.,

Yardley Wealth Management

DECEMBER 17, 2024

Interest rates remain a significant factor in financial planning, affecting everything from mortgage rates to investment returns. The past few years have taught us valuable lessons about the importance of building resilient financial strategies that can weather various economic conditions.

Million Dollar Round Table (MDRT)

JULY 8, 2025

“Efficiency is the cornerstone of a balanced work-life,” said nine-year MDRT member Gareth James Chalk, PFS , in his 2024 MDRT Annual Meeting presentation, “ Revolutionizing efficiency and engagement, AI and automation in financial planning.”

Nerd's Eye View

JANUARY 13, 2025

We've also rolled out a new private community specifically for Directors of Financial Planning (DFPs), who are increasingly becoming the lynchpins that drive planning excellence in advisory firms… which is so in alignment with our own Kitces mission that we wanted to start hosting a community for DFPs to further foster their success!

Wealth Management

JUNE 20, 2025

Davis Janowski , Senior Technology Editor, WealthManagement.com June 20, 2025 5 Min Read Dr. Naomi Win, a behavioral finance analyst at Orion, gave a presentation entitled, “Aligning Lives and Portfolios: Meeting the Moment for Modern Investors” at Wealth Management EDGE.

Clever Girl Finance

JANUARY 10, 2025

By aligning your money values with your ethics, you create a financial plan that reflects who you truly are and what matters most. Ask yourself: Are my current financial choices still aligned with what I value most? This regular check-in allows you to adjust your financial plan as needed.

Wealth Management

JULY 22, 2025

They’ll combine services, such as investment management and financial planning. This approach can be challenging for some firms but presents significant opportunities for scale and growth.” As these consolidators mature and gain scale, Cerulli said they are increasingly shifting their focus toward centralization to drive growth.

Midstream Marketing

DECEMBER 26, 2024

The Importance of Forefield Advisor Marketing in Today’s Financial Landscape In the present digital era, financial professionals face tough competition. One major benefit of Forefield is its dedication to providing the latest trends and insights in financial services.

Million Dollar Round Table (MDRT)

DECEMBER 10, 2024

I would take those numbers and spend a lot of time carefully crafting a financial plan and creating proposals. Then I would present the plan to the client. Just like that, all the time spent on their financial plan was wasted because of bad data.

Indigo Marketing Agency

JUNE 18, 2025

For families, showcase how your planning helped clients achieve their children’s education goals while maintaining their desired lifestyle. Remember to present case studies in multiple formats to maximize their impact. Why are case studies important for financial advisors, and how should I present them?

Midstream Marketing

NOVEMBER 12, 2024

This helps potential clients find you when they look for financial advice online. You might want to create blog posts, articles, or videos about current financial trends. These can also answer common questions about financial planning. This keeps your audience informed about financial planning.

Steve Sanduski

APRIL 8, 2025

Keen Wealth’s checklist-driven financial planning process. Our team is so focused on the financial planning side of the equation for everyone that they just eat up all this planning. And we’re able to model that in and present it in such a way so people can understand it.

Harness Wealth

FEBRUARY 5, 2025

tax on their income, making financial planning even more important. citizens with financial accounts overseas must comply with the Foreign Bank Account Report (FBAR) and the Foreign Account Tax Compliance Act (FATCA), which require detailed disclosures of foreign-held assets. In such cases, an expat may owe full U.S.

Zoe Financial

APRIL 7, 2025

For investors, this may be a time to revisit your financial plan, not to panic. Consider speaking with a financial advisor about risk tolerance and strategies like tax loss harvesting. Andres Disclosure: This material provided by Zoe Financial is for informational purposes only. Stay tuned for next week.

Midstream Marketing

NOVEMBER 8, 2024

Infographics that present information in a visual way. Articles: Discuss topics such as investing, retirement planning, and related subjects. E-books and White Papers: Offer detailed information on specific areas of financial planning. E-books that provide in-depth information on a subject.

Wealth Management

JUNE 11, 2025

But Here’s the Rub A comprehensive discussion along the lines suggested in the article I posted will require a lot of work by the agent, including all the data gathering, consultation with advanced planning attorneys, coordination with other advisors, presentation preparation, etc.

Tobias Financial

JUNE 15, 2025

Whether by choice or circumstance, retiring solo means you’re in full control of your financial decisions, but you also face distinct planning challenges that require thoughtful strategy. You’re planning for one, which often simplifies decisions around budgeting, income needs, and lifestyle goals,” Chad shares.

International College of Financial Planning

JUNE 5, 2025

But you do have to be present. It’s Not About Being Perfect Lets be real: I have made mistakes in my career. Said the wrong things sometimes in tough moments. What I have learned is this: you don’t have to be perfect. You have to be able to say, “I don’t know, but I’ll find out.” Or “Let’s revisit that — something doesn’t feel right.”

Diamond Consultants

FEBRUARY 11, 2025

As clients are demanding more from advisors, many firms have added subject matter expertise in the areas of advanced financial planning, tax advisory, estate planning, tax preparation, and even life coaching.

Clever Girl Finance

APRIL 22, 2025

Financial planning services 12. Parents might not be able to spend hundreds of dollars on toys at Christmas during tough economic times, but they will still buy presents. Financial planning services Financial advisors and planners are essential, especially during times of economic uncertainty.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content