Planning For When You-Know-What Hits the Fan

Wealth Management

JUNE 26, 2025

Financial advisors must consider the unexpected costs of end-of-life care in retirement planning to help clients prepare for potential care bombs.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 26, 2025

Financial advisors must consider the unexpected costs of end-of-life care in retirement planning to help clients prepare for potential care bombs.

Wealth Management

JUNE 26, 2025

The Diamond Podcast for Financial Advisors: 10 Ways Top Advisors Are Growing Their Businesses The Diamond Podcast for Financial Advisors: 10 Ways Top Advisors Are Growing Their Businesses A “Top 10” list of firm-level innovations and grassroots methodologies from some of the most successful advisors, teams and firms in the business.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Live Demo - Supercharge your Month End Close

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

JULY 2, 2025

As a result, financial advisors should start honing the services Gen X members will likely benefit from the most, including retirement planning, estate and tax planning and mortgage refinancing. They also make up the second biggest client base for financial advisors after baby boomers.

Wealth Management

JANUARY 10, 2025

A survey of DC recordkeepers found a large majority expect to see more financial advisors selling 401(k) plans with less than $5 million in assets.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. You deserve a comfortable retirement. If you don’t plan for your own retirement who will? I generally consider this a plan for the self-employed.

NAIFA Advisor Today

JUNE 13, 2025

For financial advisors helping clients prepare for retirement, understanding and planning for the costs associated with Medicare is critical. While these costs are often lower than those incurred through pre-65 health insurance, they remain significant, especially when viewed over a multi-decade retirement.

Nerd's Eye View

MAY 28, 2025

But as more individuals confront the emotional realities of this life transition, many find that the absence of structure, socialization, and identity once provided by work can create a gap that traditional retirement planning doesn't fully address. While the core elements of traditional retirement planning remain (e.g.,

Nerd's Eye View

JANUARY 3, 2025

Also in industry news this week: A survey indicates that workplace retirement plan participants with financial advisors tend to save more than their non-advised counterparts and that a strong majority of participants overall are interested in receiving professional advice (with more than 3/4 of this group expressing willingness to pay for it) A look (..)

Nerd's Eye View

JULY 4, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that Congress has passed highly anticipated tax legislation, making 'permanent' (i.e.,

Nerd's Eye View

JANUARY 17, 2025

Also in industry news this week: A recent survey indicates that members of Generation X are struggling more with retirement planning compared to older Baby Boomers and younger Millennials, potentially offering opportunities for financial advisors to help Gen Xers create a plan to 'catch up' when it comes to both their retirement savings and their financial (..)

Wealth Management

JUNE 3, 2025

A federal appeals court ruling might have long-term implications for inclusion of private market assets in retirement plans, according to Private Funds CFO. These are among the investment must reads we found this week for financial advisors.

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?).

Wealth Management

JANUARY 31, 2023

Vestwell conducted the fourth-annual “Retirement Trends Report” in fall 2022 and received responses from almost 1,300 savers, 500 financial advisors and 250 small businesses.

Nerd's Eye View

JUNE 23, 2025

Given how little time prospects spend evaluating their options, it's crucial to understand why people hire financial advisors and to communicate how their services address those drivers as clearly and effectively as possible. Financially motivated prospects, meanwhile, benefit from clarity and specificity.

The Chicago Financial Planner

OCTOBER 21, 2021

Health savings accounts (HSA) provide another vehicle to save for retirement. Many of you have the option to enroll in high-deductible insurance plans that allow the use of a health savings account via your employer. High deductible health insurance plans . Your HSA can be another leg on the retirement planning stool.

Wealth Management

SEPTEMBER 19, 2024

A new survey from Wealth Enhancement Group found many people feel behind on retirement plans but aren’t doing enough to set and meet clear goals.

The Chicago Financial Planner

FEBRUARY 2, 2024

A part of this process might include hiring a financial advisor or hiring a new financial advisor if you have decided to move on from your current advisor. Hiring the right advisor for your needs is critical. Here are six questions to ask when choosing a financial advisor: How do you get paid?

Nerd's Eye View

APRIL 8, 2025

Welcome to the 432nd episode of the Financial Advisor Success Podcast! Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households.

Wealth Management

JUNE 26, 2025

She's also the host of The Healthy Advisor , a podcast focused on advisor health and wellbeing. A native of Los Angeles, she now lives in Rocklin, Calif. Jun 20, 2025 Sign Up for Newsletters Sign up to receive the latest insights, trends, and analysis.

Nerd's Eye View

APRIL 2, 2025

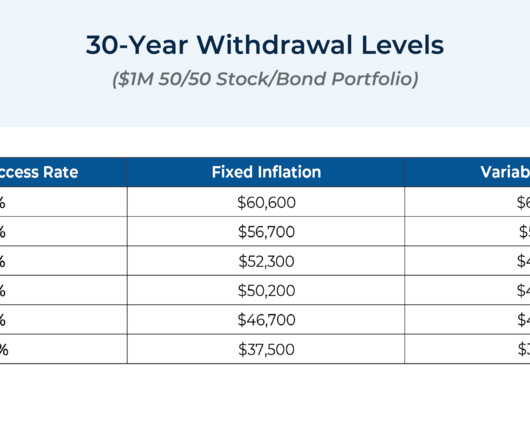

For many financial advisors, a core part of the retirement planning process involves simulating whether the client's assets will last through retirement. It's about developing a dynamic spending plan (e.g., The reality is that most people struggle to make confident decisions based on abstract reasoning.

Wealth Management

JULY 3, 2025

Jacob William Advisory has proactively recruited next-generation advisors as part of its business continuity plan. Morrison and Ring are joined by Partner and Wealth Advisor Christina Snyder, financial and wealth advisors David Hodnett and Matthew Rodgville, and a six-member operations team.

Abnormal Returns

OCTOBER 4, 2023

humansvsretirement.com) Jon Luskin talks with Steve Chen about DIY retirement planning tools. bogleheads.podbean.com) Peter Dunn on whether it is dishonest to have two financial advisors. open.spotify.com) Retirement Assessing life one year into retirement.

Carson Wealth

DECEMBER 20, 2024

While many people approach their financial planning with careful strategy, its easy to overlook the same level of intention when it comes to charitable giving. Lets explore several potentially effective financial planning tools that may help you maximize your impact and meet your philanthropic goals. government.

WiserAdvisor

JULY 2, 2025

For retirees, these trends pose a significant financial challenge. Without proper planning, healthcare expenses can quickly consume a significant portion of retirement savings. Healthcare financial advisors are invaluable in helping individuals tackle this complexity.

Nerd's Eye View

APRIL 21, 2025

When onboarding new clients, financial advisors often use a three-meeting cadence: a Discovery Meeting to gather information, a Presentation Meeting to discuss the plan, and an Implementation Meeting to finalize it. while also setting the tone for a long-term planning relationship built on trust and deeper client engagement.

Nerd's Eye View

APRIL 21, 2025

When onboarding new clients, financial advisors often use a three-meeting cadence: a Discovery Meeting to gather information, a Presentation Meeting to discuss the plan, and an Implementation Meeting to finalize it. while also setting the tone for a long-term planning relationship built on trust and deeper client engagement.

Nerd's Eye View

AUGUST 24, 2023

For many next-gen financial advisors who start with or move their careers to an established firm, eventually earning an equity stake in that firm can be an exciting prospect and is often a major career goal that many advisors aspire to achieve.

Don Connelly & Associates

JUNE 16, 2025

And that’s exactly where the opportunity lies for the advisor who does more. Nothing will destroy a retirement plan faster than a long-term care event. Seven out of ten people in America will have a long-term care event and most Advisors are not discussing it. Long-term care (LTC) is one such opportunity.

Nerd's Eye View

FEBRUARY 8, 2023

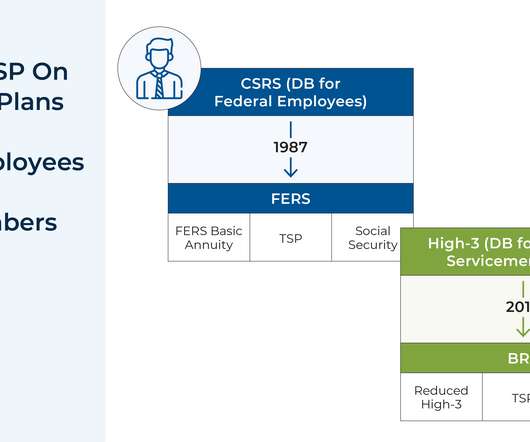

Seasoned financial advisors have likely worked with clients with a wide variety of workplace retirement accounts, which can vary in terms of their investment offerings, fees, and other characteristics. But given that the U.S. But given that the U.S. While many features of the TSP (e.g., While many features of the TSP (e.g.,

Carson Wealth

MARCH 28, 2024

Retirement planning is a journey that generally takes decades to complete and most of us start out along the do-it-yourself path. More than likely, your first step was to enroll in an employer-provided plan such as a 401(k) or setting up an individual retirement account, also known as an IRA.

Indigo Marketing Agency

JUNE 18, 2025

The Best Content for Financial Advisors to Attract Clients in 2025 Does your blog feel stale? Here’s content for financial advisors that’s actually working—and how to make it easier. What makes video so effective for financial advisors? Are your videos getting zero engagement?

Nerd's Eye View

SEPTEMBER 20, 2023

30 years ago, when financial plans relied mainly on constant investment return projections derived from straight-line appreciation and time-value of money calculations, financial advisors began acknowledging and accounting for the variable and uncertain nature of investment returns. Read More.

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading! a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

Nerd's Eye View

MAY 9, 2023

Welcome back to the 332nd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Liz Hand. Liz is the co-owner of Pleasant Wealth, a hybrid advisory firm based in Canton, Ohio that oversees $146 million in assets under management for 522 client households.

Nerd's Eye View

AUGUST 2, 2023

Which means that financial advisors can play an important role in adoption planning – helping clients strategically plan for the costs involved in the process, including accessing tax credits that can significantly defray these expenses.

Nerd's Eye View

JUNE 25, 2025

Some might prefer to retire at a more traditional age while gaining flexibility during their working years by switching to a lower-paying but more meaningful job, reducing their work hours, or taking occasional unpaid sabbaticals. changes to the client's spending, real rate of return, or retirement date) and psychological risks (e.g.,

Darrow Wealth Management

FEBRUARY 13, 2025

When starting to search for a financial advisor, investors may not realize the different types of advisors out thereand theyre not all trying to sell you something. If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products.

FMG

MARCH 3, 2025

Financial advisors know that social media isnt just for posting updates; its for building connections. Social media for financial advisors doesn’t have to be challenging let’s dive into simple ways to encourage comments on your posts. For instance, many people feel overwhelmed by retirement planning.

Zoe Financial

JUNE 20, 2025

For high-net-worth individuals, continuously refining your strategy over time is what keeps your plan efficient and aligned with evolving goals. At Zoe Financial, we’ve seen firsthand how proactive planning with a fiduciary advisor helps individuals protect and grow their wealth across generations.

Nerd's Eye View

JANUARY 26, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news of a survey indicating that about 90% of financial advisors would switch firms based on bad technology at their current firm, and that 44% have already done so. Read More.

FMG

MARCH 6, 2025

Financial Advisor Websites and the Changing SEO Landscape Staying visible online is more challenging than ever, especially for financial advisor websites. AI-powered search, social media algorithms, and Answer Engine Optimization (AEO) are transforming how potential clients find financial advisors.

Abnormal Returns

APRIL 10, 2024

(morningstar.com) Dan Haylett talks with Eric Brotman, who is the founder and CEO of BFG Financial Advisors, about retirement as 'graduation.' humansvsretirement.com) Estate planning Why you should update your estate plans periodically. wsj.com) Retirement Some reasons to go back to work after retiring.

Indigo Marketing Agency

JULY 2, 2025

Mastering the Call to Action for Financial Advisors: Stop Saying “Book a Call” Let’s talk about your call to action for financial advisors. But for many financial advisors, that CTA ends up being a button that says…“Book a Call.” As a financial advisor , clarity and trust are everything.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content