Weekend Reading For Financial Planners (June 28–29)

Nerd's Eye View

JUNE 27, 2025

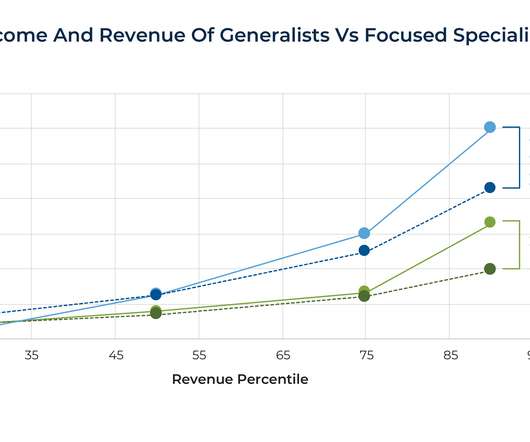

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

APRIL 18, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that as total household financial wealth grew to a record high of $90 trillion at the end of 2024, so too did the number of households advancing up the wealth ladder, with the High-Net-Worth (HNW) category of households with (..)

Nerd's Eye View

JANUARY 20, 2025

Luckily, alongside the increasing popularity of podcasts on a seemingly infinite range of topics, there is a growing ecosystem of podcasts aimed at financial advisors, covering everything from practice management and career development to technical topics, such as investment, tax, and estate planning.

Nerd's Eye View

MARCH 24, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week’s edition kicks off with the news that the CFP Board of Standards launched its 1st ad campaign, dubbed "It’s Gotta Be A CFP", following its transition to a 501(c)(6) organization.

Nerd's Eye View

JUNE 21, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5 million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey.

Nerd's Eye View

JUNE 7, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that recent surveys indicate that consumers continue to trust human financial advisors more than Artificial Intelligence (AI)-powered tools.

Yardley Wealth Management

JANUARY 21, 2025

The post Is Talking to a Financial Planner Worth It? Exploring the Benefits of Financial Planning appeared first on Yardley Wealth Management, LLC. Is Talking to a Financial Planner Worth It? ” This question crosses the minds of many people as they navigate their financial journey.

MainStreet Financial Planning

MARCH 7, 2025

The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management). Instead, they provide objective, conflict-free financial advice at a predictable cost. Are There Any Benefits to AUM-Based Advisors?

International College of Financial Planning

JULY 2, 2025

In today’s fast-changing financial world, one thing is certain—people need guidance. Rising incomes, complex tax rules, countless investment options, and growing aspirations have made personal finance decisions more challenging than ever. This is where competent, ethical, and client-first financial planners step in.

Abnormal Returns

DECEMBER 5, 2022

Podcasts Rick Ferri talks estate planning with Ryan Barrett and Mike Piper. advisorperspectives.com) IRAs Why asset location matters from a tax-perspective. wsj.com) Planning The ways that a financial planner can add value for a client are nearly limitless. Here are 101 action items.

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively. Read More.

The Big Picture

MAY 29, 2024

At The Money: Your Financial Captain with Peter Mallouk (May 29, 2024) Who’s in charge of all of the details of your financial life? Not just the stocks and bonds, but your taxes, your will, your estate, any trusts, insurance, credit line, real estate, and anything that affects your financial health.

Darrow Wealth Management

NOVEMBER 4, 2024

How to find a fiduciary financial advisor Here are 5 ways to find a financial planner who will work in your best interests. For many investors, the most important factor when trying to find a financial advisor is the location and proximity to where they live. A note of caution on near me searches.

eMoney Advisor

MARCH 7, 2023

Fortunately, financial professionals have tools and wealth transfer strategies that can help couples be intentional about the use of their assets in an estate plan. Why Focus on Estate Planning for Blended Families A thoughtful plan and good communication can go a long way in heading off conflict in large families.

Park Place Financial

NOVEMBER 29, 2022

Estates Estate Planning in this Economic Climate Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. If you are in the middle of estate planning , consider the following strategies to develop a sound plan amidst widespread economic challenges. . Create a Trust .

International College of Financial Planning

OCTOBER 26, 2023

The Imperative of Estate Planning: Not Just for the Affluent Often, there’s a prevailing misconception that estate planning is a luxury reserved for the wealthy elite. Real estate planning is a crucial undertaking that every adult and family should prioritize.

International College of Financial Planning

APRIL 20, 2022

If you are a student looking to make a career in finance, becoming a financial planner is a great place to start. Financial planning is a rewarding, stable career that can give you the opportunity to help people make the most of their money. They advise on investments, taxes, retirement, and estate planning.

Your Richest Life

JULY 17, 2024

That’s why we typically prefer passive investing , with a balance of low portfolio expenses, minimal trading costs and tax efficiency. While it helps to have a long-term plan that you’re working toward, know that ups and downs are inevitable. Money lesson #7: Find the financial planner who is right for you.

International College of Financial Planning

FEBRUARY 23, 2024

In the professional domain of finance, the role of a financial planner has become increasingly pivotal. As individuals and businesses alike strive for financial stability and growth, the demand for skilled financial planners has surged.

International College of Financial Planning

JANUARY 18, 2023

.” Today’s businesses require financial advice to fulfill their financial objectives. Selecting a career as a “financial planner” will aid in opening doors to success. If you are aspiring to become a successful financial planner? Consider the CFP course. He discussed his insights.

Validea

JULY 10, 2023

In this episode, we take a high-level look at estate planning. We cover wills, living wills, powers of attorney and the other most important documents should be put in place, the importance of trusts, the estate tax, intergenerational planning and a lot more.

International College of Financial Planning

MAY 6, 2022

A Certified Financial Planner (CFP) is a professional designation awarded to individuals who have completed a rigorous course of study and passed a comprehensive exam. The CFP designation is recognized worldwide and marks excellence in the financial planning industry. FP designation.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. Life happens.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning. In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. . Life happens.

Harness Wealth

SEPTEMBER 18, 2024

Only 26% of Americans have an estate plan. If you’re thinking, “But my clients are high-net-worth…many more have an estate plan.” These numbers show an opportunity for tax practices to build deeper, meaningful relationships with their clients, helping them to navigate some of life’s most challenging financial decisions.

Harness Wealth

APRIL 16, 2025

Roth IRA conversions present a significant challenge for retirement planners: pay taxes now or later? Moving funds from traditional IRAs to Roth accounts triggers immediate taxation but promises tax-free withdrawals in retirement. One of the Roth IRA’s most compelling features?

Carson Wealth

JULY 12, 2022

Ask financial planners about their degrees, where they are from, what they are in and when they earned the degree. . Attorneys play a critical role in the financial planning process, particularly in estate planning. In financial services, you might encounter an LLM in tax or estate planning. .

Steve Sanduski

APRIL 8, 2025

And then pivoting over into, ‘Who does your taxes? Do you have an estate plan? ’ All the things that any financial planner going through a process would talk about up to and including now, pivoting over into the assets, getting truthful about where someone stands. What’s their life look like?

Indigo Marketing Agency

JUNE 14, 2025

Advisor Spotlight: Bryan Trugman In our Advisor Spotlight Series, we aim to highlight our amazing financial advisors who go above and beyond, whether through volunteer work, unique tax planning, or thought leadership (just to name a few). Reach out to Bryan at Attitude Financial Advisors to schedule your free consultation.

Integrity Financial Planning

MARCH 1, 2023

You may be surprised to learn how important your tax strategy is when it comes to real estate investments. We also talk about what happens after someone becomes a widow and the financial decisions that come into play. 0:27) Your first call should be to a financial planner before a realtor before selling major real estate. (2:21)

Clever Girl Finance

JANUARY 22, 2024

When handled with care and used wisely, receiving a large sum of money provides a great opportunity to improve your financial situation. Table of contents What is a financial windfall? 10 steps to manage a financial windfall Expert tip: Keep living your life normally Factoring in taxes How do you deal with sudden financial windfall?

eMoney Advisor

APRIL 4, 2023

Start Estate Planning Early: It’s an important step in creating a legacy where taking the right approach and creating a specific structure can improve the likelihood of its success. Financial professionals should stress the importance of getting an early start with estate planning.

International College of Financial Planning

DECEMBER 29, 2024

The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field. As markets evolve and client needs become more sophisticated, the demand for qualified financial planners continues to grow exponentially.

Clever Girl Finance

DECEMBER 1, 2022

It's simply a structured approach to help you reach your financial goals. It details your current money situation, as well as your financial system, including things like investing, saving, retirement, and estate plans. So what is a financial plan in simple terms? Plan for taxes. Yup, taxes!

Robert B. Ritter Jr.

JANUARY 31, 2022

estate planning has escaped the tax bombs Democrats wanted to drop. With Joe Biden’s Build Back Better (BBB) collapsed, it’s back to rational planning concepts, like the intentionally defective […]. It looks like U.S.

Harness Wealth

JUNE 30, 2023

Whether you’re building equity in a primary residence or buying a vacation home or investment property, understanding how to best prepare for, and manage, a real estate purchase is a critical piece of any personal financial plan. and Financial Planning for Estate Planning.

Yardley Wealth Management

SEPTEMBER 24, 2021

Keep your taxes low. Taxes matter more than ever. “In what looks to be a low return environment where it seems taxes must go up, investors need to keep more of their investment returns. That means utilizing taxable accounts, tax-efficient and tax-managed equity funds, and tax-free muni funds,” Garry said.

International College of Financial Planning

JULY 10, 2023

CFP, or the Certified Financial Planner exam, is a significant milestone in becoming a certified financial planner. Keeping up with industry trends will help you in the CFP exam and your future career as a certified financial planner. Get in touch to get an insight into the CFP course details.

Harness Wealth

JUNE 9, 2023

Table of Contents What is a Financial Plan? Why is Financial Planning so Important? Crafting Your Personalized Financial Plan: A Step-by-Step Guide The Role of a Wealth Manager or Financial Planner Harness Wealth Can Help What is a Financial Plan?

International College of Financial Planning

APRIL 25, 2024

Achieving the status of Certified Financial Planner® (CFP®) represents a significant professional milestone in financial services. What Is a Certified Financial Planner®? A Certified Financial Planner® is a distinguished professional who has met the stringent standards set by the FPSB Board.

WiserAdvisor

SEPTEMBER 1, 2022

What to expect when meeting with a financial advisor? If you wish to have a firm grip on your finances and want to learn about different strategies related to investing, tax-saving, or retirement planning, consult with a professional financial advisor who can advise you on the same. When you’re planning your legacy.

MainStreet Financial Planning

MAY 17, 2023

Ultimately, our role as financial planners and coaches are to empower you to select the option that best suits your lifestyle, preferences, and evolving care needs as you navigate the aging process. Here are the most popular: Aging in Place: Staying in your own home while bringing in any necessary assistance and care as you age.

WiserAdvisor

JUNE 2, 2023

These professionals also hold expertise in various fields, such as retirement planning, tax management, estate planning, investment management, insurance, debt management, wealth management, and more. Need a financial advisor? Their main area of focus is wealth preservation.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content