Offering Tax Preparation As A Solo Advisor: How To Attain Designations And Create A Schedule By Next Tax Season

Nerd's Eye View

MAY 8, 2023

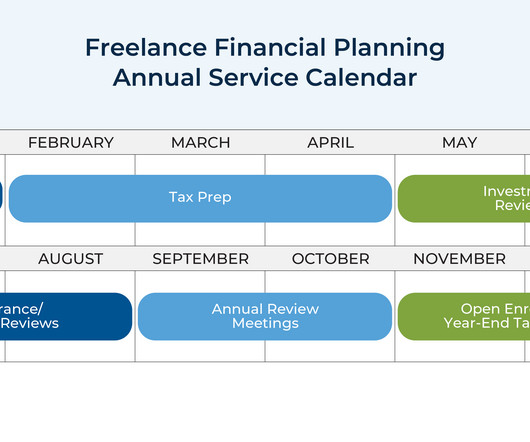

investment reviews in the summer, retirement projection updates in the fall, and year-end tax planning in the winter) created enough efficiency through systematizing the ongoing financial planning process that allowed him to fit in tax preparation without reducing any of his other service offerings!

Let's personalize your content