The Flows

The Irrelevant Investor

JANUARY 7, 2021

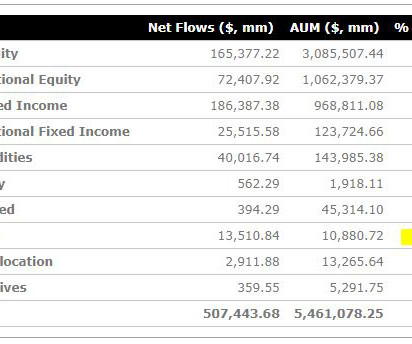

"The top 20 ETFs to debut in 2020 by total fund assets include only three products from BlackRock Inc. and none from Vanguard Group or State Street Corp., according to data compiled by Bloomberg. " There are four main themes that I'm most interested in for the ETF marketplace. The first one, tied to the quote above, is maturation. While active equity funds continue to hemorrhage money, flows into passive have plateaued over the last few years.

Let's personalize your content