The Golden Years

The Irrelevant Investor

MAY 31, 2016

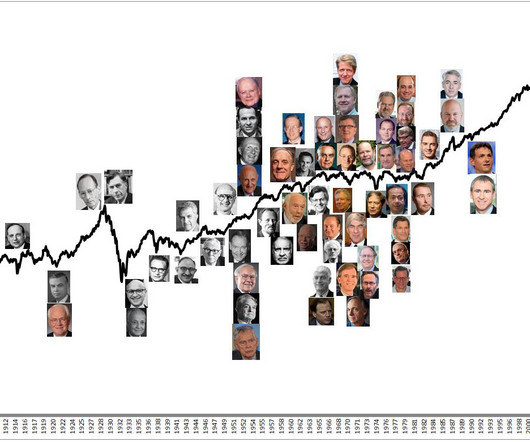

"I've been there for all the golden years and I can tell you they weren't golden at the time" - Lorne Michaels This was Lorne Michael's response to Marc Maron when asked about the golden years of Saturday Night Live. How is it possible that he missed this with legends like Bill Murray, Chevy Chase, and Dan Aykroyd? Because it's in our DNA- we often fail to recognize how great the now is.

Let's personalize your content