The Ghost of Tech Stocks Past

The Irrelevant Investor

JUNE 30, 2018

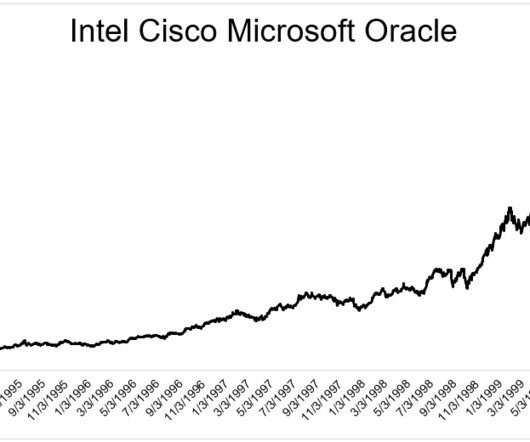

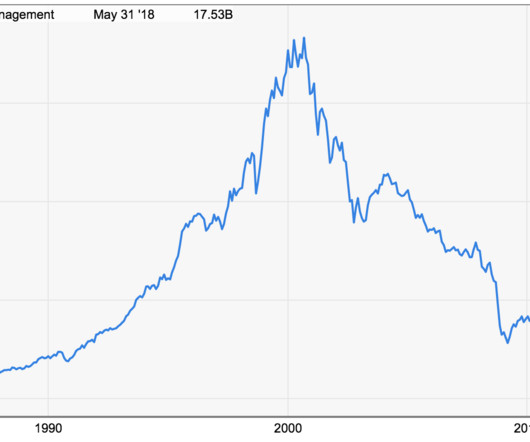

In the beginning of 1995 Intel, Cisco, Microsoft, and Oracle, were worth a combined $83 billion. One giant bubble and five years later, they had grown to $1.85 trillion. As a group, these four stocks gained 2150% over this time, or 80% a year. The table below breaks down the combined percentage gain and market cap gain by year. From 1995 until the peak in March 2000, these four added $1.768 trillion in market cap.

Let's personalize your content