Real Estate Newsletter Articles this Week: Mortgage Delinquencies Increase, Foreclosures Remain Low

Calculated Risk

FEBRUARY 22, 2025

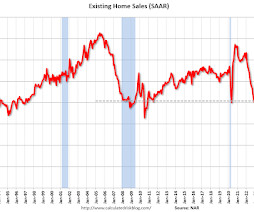

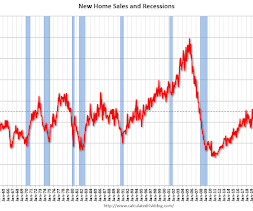

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. NAR: Existing-Home Sales Decreased to 4.08 million SAAR in January Housing Starts Decreased to 1.366 million Annual Rate in January The "Neutral" Rate and Implications for 30-year Mortgage Rates California Home Sales Down 1.9% YoY in January; 4th Look at Local Housing Markets Lawler: Early Read on Existing Home Sales in January This is usually published 4 to 6 times a week and provides more in-depth an

Let's personalize your content