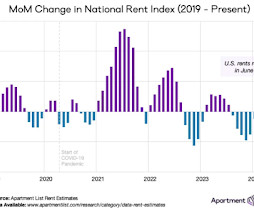

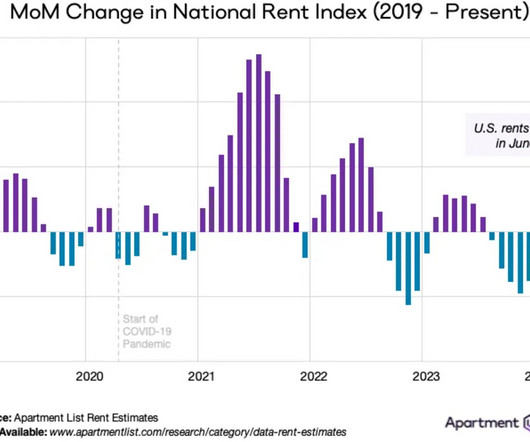

Asking Rents Mostly Unchanged Year-over-year

Calculated Risk

JULY 2, 2024

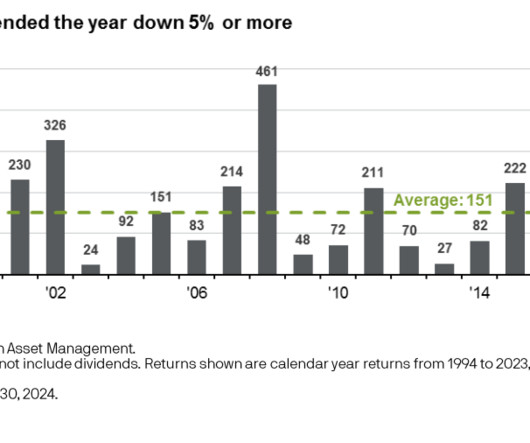

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year Brief excerpt: Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand ).

Let's personalize your content