This Week on TRB

The Reformed Broker

MARCH 25, 2023

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. . The post This Week on TRB appeared first on The Reformed Broker.

The Reformed Broker

MARCH 25, 2023

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. . The post This Week on TRB appeared first on The Reformed Broker.

Calculated Risk

MARCH 25, 2023

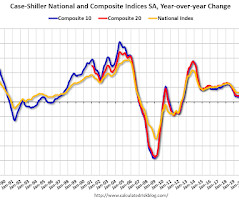

At the Calculated Risk Real Estate Newsletter this week: • NAR: Existing-Home Sales Increased to 4.58 million SAAR in February; Median Prices Declined YoY • New Home Sales at 640,000 Annual Rate in February • Final Look at Local Housing Markets in February • House Prices: Rust or Bust? • More Good News for Homebuilders This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

MARCH 25, 2023

This week, we speak with former hedge fund manager Dominique Mielle, author of 2021’s “ Damsel in Distressed: My Life in the Golden Age of Hedge Funds.” Mielle spent two decades as a partner and senior portfolio manager at Canyon Capital Advisors and was named one of the “50 Leading Women in Hedge Funds” by the Hedge Fund Journal and E&Y. She currently serves on the boards of four publicly traded firms and one private company.

Calculated Risk

MARCH 25, 2023

The key reports scheduled for this week include the 3rd estimate of Q4 GDP, February Personal Income & Outlays, and January Case-Shiller house prices. For manufacturing, the March Dallas and Richmond Fed surveys will be released. -- Monday, March 27th -- 10:30 AM: Dallas Fed Survey of Manufacturing Activity for March. -- Tuesday, March 28th -- 9:00 AM: S&P/Case-Shiller House Price Index for January.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Advisor Perspectives

MARCH 25, 2023

The U.S. dollar remains the world’s top reserve currency for now, though its share of global central banks’ official holdings has slipped in the past 20 years. By contrast, the yuan’s share of official holdings has more than doubled since 2016.

Trade Brains

MARCH 25, 2023

Top Electricity & Power Sector Companies: The first electric street light in Asia was lit in Bangalore on 5th August 1905. Despite what seemed like a headstart the electrification of India seemed like an uphill battle for almost a century. However, in the last decade, India has begun to make strides not only in extending electrification throughout the country but also in introducing greener alternatives.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Sara Grillo

MARCH 25, 2023

As a business owner, you need to be able to anticipate issues and develop plans in advance. Fortunately, you can use resources to create financial projections that forecast your future revenue and expenses. Although the future is uncertain, financial projections can give you valuable insight that helps you predict the path of your business. Here, Ed Carter of AbleFutures explains how financial projections can help your business succeed.

Advisor Perspectives

MARCH 25, 2023

Following recent efforts by central banks and regulators to alleviate the banking crisis, Franklin Templeton Institute’s Stephen Dover and Lukasz Kalwak discuss their thoughts on the implications and outlook for the banking industries in the United States and Europe.

The Big Picture

MARCH 25, 2023

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • A Four-Decade Secret: One Man’s Story of Sabotaging Carter’s Re-election : A prominent Texas politician said he unwittingly took part in a 1980 tour of the Middle East with a clandestine agenda. ( New York Times ) • The venture capitalist’s dilemma : The embarrassing investor meltdown surrounding Silicon Valley Bank should drive us to consider new models. ( Molly Whi

Advisor Perspectives

MARCH 25, 2023

As interest rates show signs of peaking, gold prices are nearing new all-time highs.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Aleph

MARCH 25, 2023

Picture Credit: David Merkel, with an assist from the YouImagine AI image generator || Twitter bird visits China Banking Saba Capital’s Boaz Weinstein talks bank CDS; Carvana exchange falters; Evergrande reveals restructuring plan [link] Thinks bank sub debt is overpriced in general… Mar 24, 2023 US authorities guarantee bank deposits as high as $250,000.

Advisor Perspectives

MARCH 25, 2023

Recently I saw someone share a clip from their weather app. It said, “Rain expected at 3 pm,” right above a little graphic showing a 30% chance of rain at 3 pm. What’s wrong with that picture?

Abnormal Returns

MARCH 25, 2023

EVs Lithium prices are down some 20% YTD, which is good for the EV ecosystem. (nytimes.com) EVs still take too many design cues away from ICEs. (reviewgeek.com) Energy Wind and solar made up 92% of India’s power generation capacity additions in 2022. (ember-climate.org) How geothermal wells can be used like a battery. (technologyreview.com) Environment The world is on track to hit 1.5 degrees Celsius warming by 2035 if current trends continue.

Advisor Perspectives

MARCH 25, 2023

Slower credit growth may curtail broader U.S. economic growth, taking pressure off the Federal Reserve.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Advisor Perspectives

MARCH 25, 2023

China’s economy is in the early stages of a gradual, consumer-led recovery. In this issue of Sinology, Andy Rothman outlines why China’s opportunities outweigh risks.

Advisor Perspectives

MARCH 25, 2023

Realty Income, A.K.A. the Monthly Dividend Company, has rarely been attractively valued since the spring of 2010. However, rising interest rates have brought the price down to fair value.

Let's personalize your content