Weekend Reading For Financial Planners (March 25-26)

Nerd's Eye View

MARCH 24, 2023

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 30, 2025

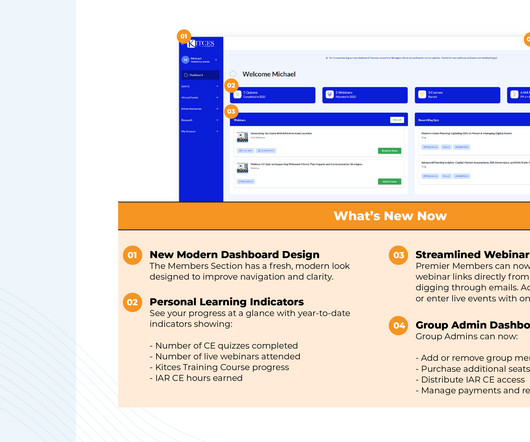

Which led us at the beginning of 2025 to announce a major new initiative for the year: to completely rebuild and replace our existing Members Section , which has struggled to keep pace with the growth of our Membership and the expanded breadth of our educational offerings to Members.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

International College of Financial Planning

JULY 2, 2025

And for those looking to become such professionals, the question naturally arises: Is pursuing the Certified Financial Planner (CFP) certification worth it in India? What is the CFP Certification? The Certified Financial Planner (CFP) certification is widely regarded as the gold standard in personal financial planning.

Yardley Wealth Management

DECEMBER 17, 2024

Retirement Planning: Looking Beyond the Basics For 2025, it’s essential to think beyond the standard “maximize your 401(k)” advice. While that remains important, consider diversifying your retirement strategy. I’ve seen clients significantly boost their income by strategically investing in their careers.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. Individuals who earn this certification are thoroughly prepared to offer expert financial advice.

Carson Wealth

JULY 12, 2022

We speak a secret language in financial planning. So much of our world is filled with abbreviations surrounding insurance and investment products, processes, education and accomplishments. . Translating from the secret language of financial planning, the sentence would read “Tammy specializes in insurance. Conferred Degrees.

International College of Financial Planning

FEBRUARY 23, 2024

At the heart of this profession lies the financial planner certification, a credential that not only signifies expertise but also opens doors to significant career opportunities. This certification is recognized globally and is considered a benchmark for competence and professionalism in financial planning.

Indigo Marketing Agency

JUNE 12, 2025

Most financial advisors enjoy working with hardworking, educated, long-term planners who have money to invest today for a respectable return tomorrow. Don’t forget to showcase your credibility through client testimonials, case studies , and any relevant certifications or achievements that build trust—in a compliant way, of course.

International College of Financial Planning

OCTOBER 26, 2023

Their wisdom extends to suggesting tax-efficient avenues for pivotal life moments, be it education or the golden years of retirement. Achieving them typically involves: Completing a dedicated education program. They’re well-versed in recommending vital products like life insurance and are wizards at tax planning.

MazumaBusinessAccounting

MAY 31, 2022

Keep the following documents for seven or more years: Income tax returns (federal and state) W-2s and 1099s Medical bills Contracts Receipts for tax-deductible items Mileage records Canceled checks Real estate tax forms Credit cards statements that contain purchases used as tax deductions Retirement plan contributions.

International College of Financial Planning

JUNE 17, 2025

Increase Investor Literacy: Use awareness campaigns, workshops, and institutional outreach to educate investors. Remittance strategies should be phased to manage currency risk, especially for education and retirement planning.

International College of Financial Planning

DECEMBER 4, 2023

Educational and Certification Pathways The path to becoming a financial advisor typically starts with a solid educational background in finance, business administration, or economics. Expertise and Knowledge Recognition: Globally acknowledged, the CFP® is often seen as the pinnacle in financial planning.

International College of Financial Planning

SEPTEMBER 7, 2024

The CFP® Fast Track course offers a quick, efficient pathway to certification, allowing you to accelerate your career in the financial planning industry. Cost-Effective: The fast-track program reduces certification fees by 30-40%, making it more affordable. What Is the CFP® Fast Track Course?

International College of Financial Planning

JANUARY 15, 2024

Embracing Financial Planning Courses Online versus On-Campus Learning The advent of online financial planning courses marks a pivotal shift in educational methodologies. On-Campus Learning: A Rich Educational Tapestry Contrasting to the online experience, on-campus learning offers a more immersive educational journey.

International College of Financial Planning

SEPTEMBER 23, 2024

This program offers a streamlined route to earning the prestigious Certified Financial Planner (CFP®) certification, especially for experienced professionals or those with advanced qualifications in finance. b) Increased Earning Potential Obtaining a CFP® certification significantly enhances your earning potential.

Harness Wealth

APRIL 17, 2025

The calculation becomes increasingly complex for higher-income taxpayers , as it introduces factors such as W-2 wages paid to employees, the unadjusted basis of qualified property, and retirement plan contributions. Partner with Harness for top-tier advisory services in financial, tax, and estate planning.

Trade Brains

DECEMBER 7, 2023

Personal Finance for Beginners by FinGrad FinGrad Academy is an educational platform that offers various courses on financial products for better investment opportunities. Personal Finance – Mutual Funds course by Zerodha Varsity Zerodha Varsity is an educational platform that offers all financial content in different modules.

International College of Financial Planning

MARCH 9, 2024

This blog is designed to illuminate the path to becoming a CFP® professional, focusing on the critical steps involved in the admission process, exploring the myriad of career prospects, delving into the eligibility criteria, and the future of the CFP® certification.

Good Financial Cents

SEPTEMBER 29, 2022

Share insights in a community and access a wealth of educational content. Traditional IRA: Best for Dedicated Retirement Planning. IRA plans are subject to Required Minimum Distributions (RMDs) beginning at age 72. Roth IRA: Best for Retirement Planning + Immediate Funds Access. Ads by Money.

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Long-term goals typically encompass retirement planning, wealth preservation and estate planning.

International College of Financial Planning

AUGUST 2, 2021

The simplest definition of the role of a financial advisor would of that of a person who helps individuals, families, and organizations make decisions related to their investments, taxes, insurance planning, retirement planning, estate planning, and money management. Educational Qualification Requirements.

International College of Financial Planning

MAY 1, 2023

Understand the Role of a Financial Advisor A financial advisor is an expert who provides guidance and recommendations on diverse financial matters, including tax strategies, investments, insurance, and retirement planning. Some potential avenues include corporate Finance, investment banking, and portfolio management.

International College of Financial Planning

JULY 10, 2023

Some common career paths for investment advisors include working as wealth manager, family office, portfolio manager (PMS), Retirement Planner, Estate Planner. Investment advisors can also specialize in specific areas such as retirement planning, tax planning, or portfolio management.

International College of Financial Planning

JULY 30, 2022

Credentials matter in any profession and when it comes to personal finance, there’s no certification more highly coveted than Certified Financial Planner. Earning the CFP designation requires a rigorous course of study covering investment planning, income taxation, retirement planning and risk management.

International College of Financial Planning

NOVEMBER 10, 2021

It wasn’t too long ago when investments would mean going to the bank and following the advice of the bankers or calling in neighborhood uncle to buy term-deposit certificates or insurance. You’d perhaps need to undergo special certifications as you enter the industry but MBA (Finance) remains a good starting point.

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Long-term goals typically encompass retirement planning, wealth preservation and estate planning.

Good Financial Cents

JANUARY 26, 2023

Important Considerations if Retiring at 50 is a Real Goal If you want to retire at 50, there are some important considerations to take into account. That means understanding the stock market, planning for debt and savings, and investing in yourself through education or entrepreneurial ventures. Ads by Money.

International College of Financial Planning

JUNE 25, 2024

Job-Oriented Courses When it comes to higher education, students often face a dilemma between traditional degree programs and job oriented courses after 12th. They provide a comprehensive education that includes a broad range of subjects, giving students a well-rounded knowledge base.

Zoe Financial

FEBRUARY 21, 2023

Additionally, financial advisors focus on helping you achieve long-term goals like retirement planning. They may also offer services such as setting up investment accounts or retirement plans that fit your unique needs. When looking for a financial advisor, ensure they’re certified.

Clever Girl Finance

OCTOBER 9, 2023

Here are some examples: Prepare for retirement There are quite a few ways to do this, from a 401k if you have the option to IRAs or regular investing. While retirement planning can seem overwhelming, it’s actually not too difficult to get started. Then you can make a plan for your savings.

Clever Girl Finance

NOVEMBER 8, 2022

When you decide to start investing, the most important part of the process is educating yourself. Consider certificates of deposits. Certificates of deposits (CDs) are good investments for beginners and a safe place to grow your money if you have a low-risk tolerance. Investing money for beginners doesn't have to be hard either!

International College of Financial Planning

SEPTEMBER 3, 2021

The proof can be in the form of an educational certificate or a professional license or any other document that will provide the best evidence of your identity. Education is one of the most important tools you can use to prepare for your financial future. Proactivity. Find someone of trust and name.

WiserAdvisor

JUNE 19, 2022

Other than these, the most straining cost is child care and education. To claim these benefits, you will need a Social Security number and submit it at the time of providing the child’s birth certificate details or at a Social Security office. The cost of education in the U.S. has tripled in the last three decades.

Clever Girl Finance

NOVEMBER 25, 2023

When you decide to start investing, the most important part of the process is educating yourself. Consider certificates of deposit (CDs) Certificates of deposit (CDs) are a safe place to grow your money if you have a low risk tolerance. Investing money for beginners doesn’t have to be hard either!

International College of Financial Planning

JULY 10, 2023

These encompass a wide array of subjects such as professional conduct and regulation, general principles of financial planning, and specific areas like estate planning, tax planning, investment planning, retirement planning, risk management, and insurance planning.

International College of Financial Planning

MARCH 31, 2023

Key Benefits of the Program The Integrated Diploma in Wealth Management program offers several benefits for aspiring wealth managers, including: Industry-recognized certification : The program is designed to provide students with the necessary skills and knowledge to become successful wealth managers.

Good Financial Cents

AUGUST 11, 2022

Certificates of Deposit (CDs). The first place I would park some of the money is in a Certificate of Deposit (CDs). A Certificate of Deposit (CD) is pretty much the safest and most guaranteed investment you can make. Or, you might throw it into a Certificate of Deposit with Discover Bank. You’ve now turned a new leaf.

WiserAdvisor

JUNE 2, 2023

These professionals also hold expertise in various fields, such as retirement planning, tax management, estate planning, investment management, insurance, debt management, wealth management, and more. They help prepare a retirement plan based on a client’s financial needs and goals.

Envision Wealth Planning

MARCH 17, 2022

Upon passing the Series 65 exam, an investment adviser representative does not have to earn continuing education credits to further their knowledge, such as the Certified Financial Planner designation. I liken the Uniform Investment Adviser Law Exam registration to “just getting over the hurdle,” but not by much.

Clever Girl Finance

NOVEMBER 4, 2022

For example, your plan may include saving for retirement by automatically depositing part of your paycheck into a 401(k)-retirement plan. Some common long-term goals include: Saving for retirement. Paying for your children’s education. Paying off your mortgage.

WiserAdvisor

APRIL 16, 2025

Planning for retirement is one of the biggest financial challenges you will ever face, and a financial advisor can help you adopt a strategy that can take you to your goals, mitigate risk, and adapt to the changes that will inevitably come your way. Retirement planning can be a long-term journey, and a lot can change along the way.

Clever Girl Finance

JULY 16, 2023

To offer this, many advisors complete specific training and hold professional certifications. You can learn about the stock market, bonds, budgeting, retirement planning, and saving. Do they have the right certifications and credentials? They’ll devise plans to support your specific requirements.

Clever Girl Finance

JULY 16, 2023

To offer this, many advisors complete specific training and hold professional certifications. You can learn about the stock market, bonds, budgeting, retirement planning, and saving. Do they have the right certifications and credentials? They’ll devise plans to support your specific requirements.

WiserAdvisor

APRIL 4, 2025

They must qualify for examinations and possess numerous certifications before they are allowed to work professionally. For example, buying a home, planning for a childs education, or preparing for retirement are deeply personal milestones that affect your state of mind as much as they impact your financial situation.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content