3 Question Types To Go From (Just) Retained To Highly Engaged And Happier Clients

Nerd's Eye View

APRIL 17, 2024

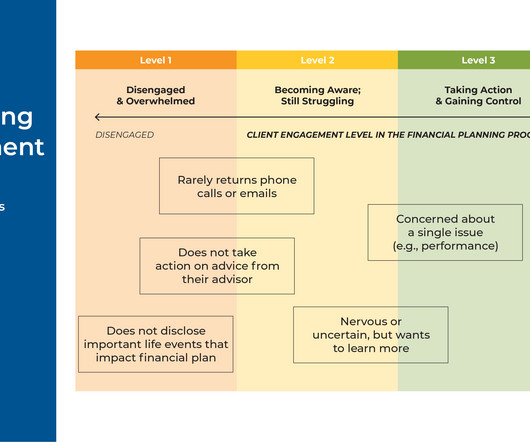

Compliance!), And while all may appear well on the surface – the client rarely contacts the advisor with problems but they show up for every annual meeting – they may actually be feeling quite disengaged with the financial planning services being provided. Prospecting! Onboarding!

Let's personalize your content