Financial Market Round-Up – Oct’24

Truemind Capital

OCTOBER 18, 2024

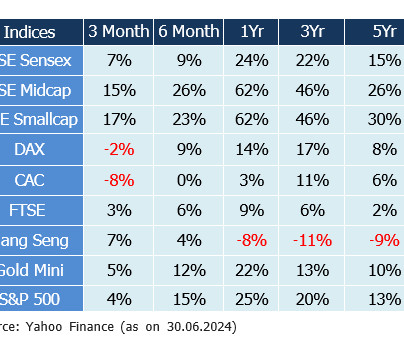

That’s exactly what we’ve seen in India’s financial markets in the quarter ending September 2024. Here is what’s happening currently- Stock markets are rising Bond Prices are increasing / Bond Yields are falling Gold is trending upwards Real Estate Prices are inching upwards ALL KEY ASSET PRICES ARE GOING NORTHWARDS!

Let's personalize your content