Three Things – Weekend Reading

Discipline Funds

AUGUST 16, 2024

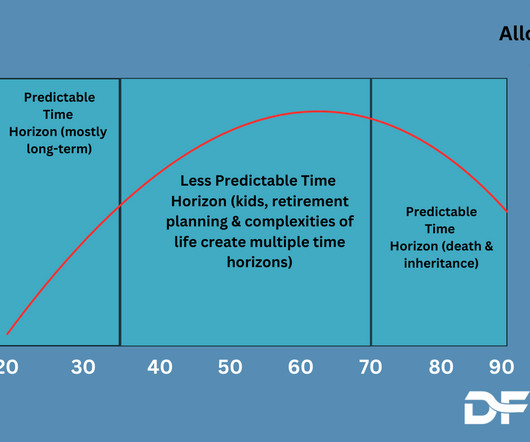

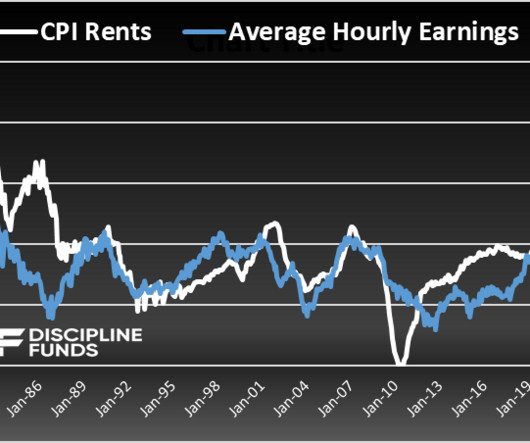

The Great Financial Crisis was wonderful because it got people interested in economics. And it was terrible in that it convinced a lot of people that mainstream economics was wrong about almost everything. You’re either going to pass away soon OR the assets will become someone else’s. But I think this is wrong.

Let's personalize your content