Weekend Reading For Financial Planners (June 28–29)

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

MARCH 3, 2025

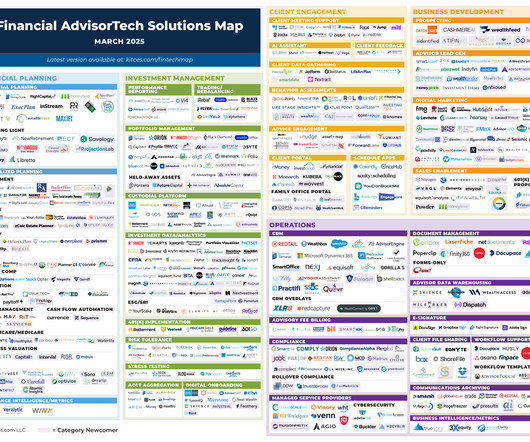

Welcome to the March 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

MAY 8, 2023

kitces.com) How personality traits affect estate planning decisions. thinkadvisor.com) A number of tax provisions will sunset in 2026 including the lifetime exclusion amount. thomaskopelman.com) An increasing number of states are introducing auto-IRAs. investmentnews.com)

Darrow Wealth Management

JULY 1, 2024

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. In 2026, this is all expected to change (again).

WiserAdvisor

JULY 4, 2025

The numbers you saw on your 2024 return probably will not be the same in 2025. You must meet all of the following conditions to be eligible for the EITC in 2025: You must have a valid Social Security number You must be a U.S. Estate tax credits and gift tax exclusion Let’s talk estate planning for a moment.

Darrow Wealth Management

JULY 1, 2024

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. In 2026, this is all expected to change (again).

Brown Advisory

NOVEMBER 1, 2019

These conditions present a variety of challenges for investors; more germane to our discussion in this letter, they also present a number of planning opportunities that may require near-term action. Market conditions may be volatile, but our planning efforts are, as always, focused on stability and consistency. Treasuries).

Let's personalize your content