Weekend Reading For Financial Planners (December 28–29)

Nerd's Eye View

DECEMBER 27, 2024

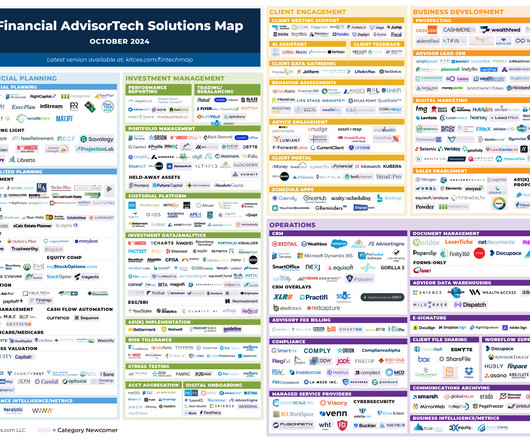

Also in industry news this week: According to a recent survey, advisors are putting an increasing share of client assets into model portfolios, allowing for customization and time savings that advisors appear to be using to provide more comprehensive planning services RIA M&A deal volume saw an annual record in 2024 as a lower cost of capital, (..)

Let's personalize your content