Weekend Reading For Financial Planners (May 3–4)

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

Nerd's Eye View

JUNE 9, 2025

It quickly became a perennial favorite on Nerd's Eye View, and so I've updated it every year, with new lists of books in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022, 2023, and a fresh round last year in 2024. Read More.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

AUGUST 5, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the SEC has issued a new bulletin clarifying the responsibilities of brokers under Regulation Best Interest (Reg BI). Enjoy the ‘light’ reading! Read More.

Nerd's Eye View

SEPTEMBER 2, 2022

From there, we have several articles on investments: How Morningstar plans to simplify its rating system amid continued concerns about its effectiveness. A study suggests that some fund companies are misleading investors by changing their benchmark indices to make their performance look better.

Nerd's Eye View

SEPTEMBER 9, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that as Millennials grow their wealth, they could be increasingly turning to financial advisors for guidance.

Nerd's Eye View

NOVEMBER 3, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Department of Labor this week released its long-awaited "retirement security rule", its latest effort to curb conflicts of interest around retirement savings recommendations.

Nerd's Eye View

JANUARY 20, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that several states are considering a series of tax hikes targeting higher-income and ultra-high-net-worth residents after similar proposals failed to pass at the Federal level. Read More.

Nerd's Eye View

DECEMBER 2, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with a research study suggesting that the market volatility experienced in 2022 could increase demand for financial planning services.

Nerd's Eye View

JANUARY 19, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study has found that while total financial advisor headcount across all channels only increased by 0.3% in 2023, the RIA space showed significantly more strength, with 10.4%

Nerd's Eye View

OCTOBER 21, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congress appears poised to pass a series of changes affecting retirement planning, dubbed “SECURE ACT 2.0”, ”, by the end of the year. Social Security COLA for 2023.

Nerd's Eye View

AUGUST 12, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the U.S.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. If you don’t plan for your own retirement who will? Two popular small business retirement plans are the SEP-IRA and Solo 401(k). The maximum for 2022 is $61,000, this has been increased to $66,000 for 2023. Eligibility.

Nerd's Eye View

AUGUST 12, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the U.S.

Nerd's Eye View

OCTOBER 23, 2023

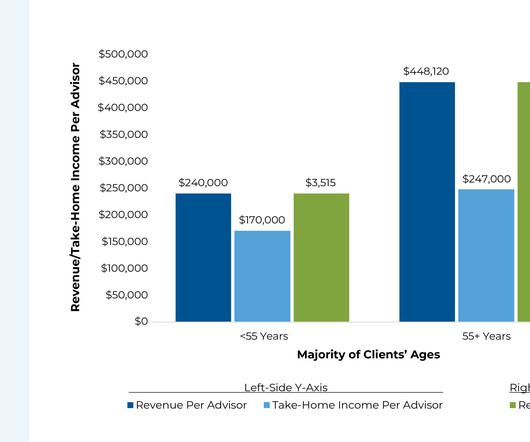

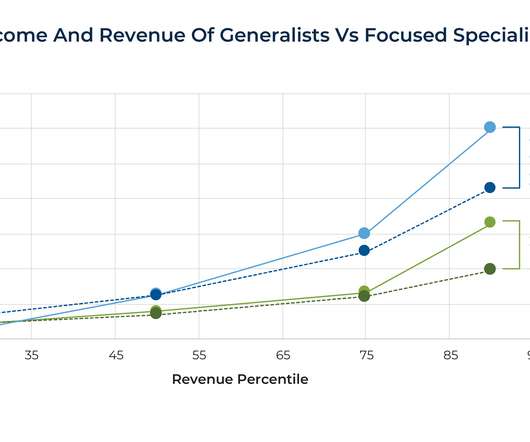

Though, at some point, covering a large number of financial planning topics can eat into an advisor's time, which is problematic if clients won't pay substantially more to receive that more comprehensive advice.

The Chicago Financial Planner

OCTOBER 21, 2021

Many of you have the option to enroll in high-deductible insurance plans that allow the use of a health savings account via your employer. High deductible health insurance plans . These types of plans are becoming more common with employers and are available privately as well. How the HSA works . Click To Tweet.

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively.

Abnormal Returns

JULY 31, 2023

riaintel.com) Creative Planning has inked a custody deal with Goldman Sachs ($GS). morningstar.com) QLACs are coming to the 401(k) plan. wsj.com) Fraud Sadly, family members engage in a lot of elder financial exploitation. theatlantic.com) 2022 saw a jump in investment fraud. financial-planning.com)

Abnormal Returns

DECEMBER 26, 2022

Podcasts Michael Kitces talks setting boundaries with Emily Rassam who is the Senior Financial Planner for Archer Investment Management. morningstar.com) Ryan Detrick and Sonu Varghese talk with Phil Pearlman about the connection between health and wealth planning. riaintel.com) The case for pre-hiring in anticipation of growth.

eMoney Advisor

DECEMBER 14, 2022

What were financial planners interested in reading this year? Fact-finding, retirement literacy, and leading with planning round out the list of hot topics for 2022. 6 Effective Financial Professional Prospecting Tactics. Financial Planning KPIs Your Firm Should Be Tracking.

The Chicago Financial Planner

FEBRUARY 6, 2022

In spite of what was said on PBS Frontline The Retirement Gamble and elsewhere in the press, in my opinion 401(k) plans are one of the best retirement savings vehicles available. Here are 4 steps to make sure that your 401(k) plan is working hard for your retirement. There are a number of retirement plan options to consider.

The Chicago Financial Planner

JUNE 13, 2022

After a strong finish in 2020 and very solid returns in 2021, we’ve seen a lot of market volatility so far in 2022. Assuming that you have a financial plan with an investment strategy in place there is really nothing to do at this point. If not perhaps you are taking more risk than you had planned. Do nothing.

The Chicago Financial Planner

FEBRUARY 3, 2022

Today’s decline is on top of high levels of market volatility that we’ve seen so far in 2022. Before making any investment be sure that it fits your strategy and your financial plan. Stick to your plan, review your holdings and make some adjustments if needed. The Bottom Line .

Nerd's Eye View

MARCH 27, 2023

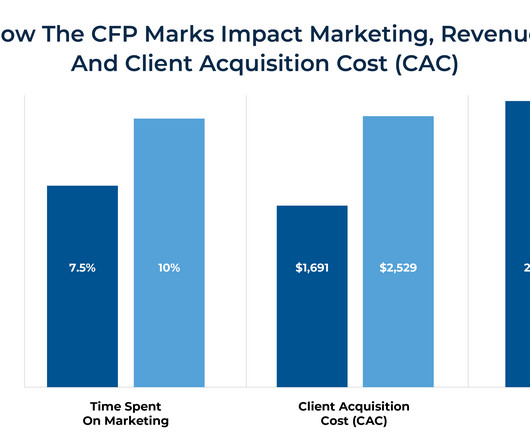

According to the 2022 Kitces Research study, “How Financial Planners Actually Market Their Services”, advisors without the CFP marks typically spend more of their time on marketing activities relative to CFP practitioners (allowing them to spend more time on higher-value tasks).

Nerd's Eye View

SEPTEMBER 18, 2023

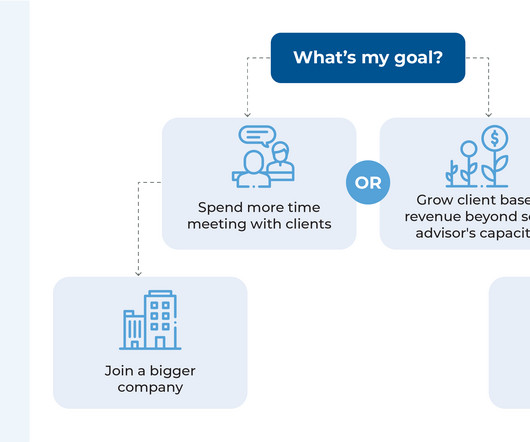

Data from the 2022 Kitces Research Study on “How Financial Planners Actually Do Financial Planning” provide some answers about what advisors can expect when going beyond a solo practice, shedding light on the impact that hiring has on advisor capacity. What type(s) of employee should they hire?

Nerd's Eye View

MAY 23, 2023

Welcome back to the 334th episode of the Financial Advisor Success Podcast ! Meg is the Founder and Lead Financial Planner for Flow Financial Planning, a virtual RIA serving mid-career women in tech that oversees almost $60 million in assets under management for 60 client households.

eMoney Advisor

DECEMBER 15, 2022

In an era of uncertainty, the value Americans place on professional advice from a financial planner has increased. adults said their most trusted source of financial advice was a financial advisor. Financial Planner Job Growth in the Next Decade. The Financial Planning Workforce.

The Chicago Financial Planner

DECEMBER 5, 2021

For 2022 these limits increase to $61,000 and $67,500. For 2022 these contribution limits increase to $20.500 and $27,000, plus the employer-funded profit sharing component in both years. Just like a 401(k) plan with an employer, the Solo Roth 401(k) option allows larger Roth contributions than the Roth IRA limits.

eMoney Advisor

MAY 1, 2023

When asked about how they started in the industry, many of the Asian-American financial planners I admire say the same thing: At first, they didn’t even know the profession existed. ” Only 4 percent of Certified Financial Planner™ professionals identify as Asian American or Pacific Islander (AAPI), though they make up 6.2

Abnormal Returns

NOVEMBER 21, 2022

Podcasts Jeff Ptak and Christine Benz talk with Feraud Calixte who is the founder and lead financial planner of Vantage Pointe Planning. advisorpedia.com) Ryan Donovan and George Svagera speak with Matt Middleton, CEO at Advisor Circle, about the future of financial conferences. unit debt-free in 2023.

eMoney Advisor

JANUARY 12, 2023

If you’ve resolved to add more meaning to your work in 2023 using your skills as a financial planner, you’ve come to the right place. We’ve gathered seven unique volunteer opportunities for financial professionals, including pro bono financial planning. Foundation for Financial Planning.

The Chicago Financial Planner

OCTOBER 20, 2021

This increases to $19,560 for 2022. For 2021 this increased limit is $50,520, for 2022 this limit is $51,960. Check out my freelance financial writing services including my ghostwriting services for financial advisors. Social Security and Working – What You Need to Know is a post from: The Chicago Financial Planner.

Carson Wealth

AUGUST 25, 2022

Among these are your longevity, lifestyle, comfort with market performance, sequence of return risk, current health, housing plan, proportion of fixed to variable expenses, proximity to children and so much more. Focus on Your Retirement Plan Rather Than a Magic Number. would be “How do I plan for retirement?“

International College of Financial Planning

DECEMBER 9, 2024

The financial planning industry has witnessed remarkable growth, making the Certified Financial Planner (CFP) certification increasingly valuable for professionals seeking to advance their careers. Financial planning has emerged as one of the most rewarding career paths in the modern financial sector.

eMoney Advisor

APRIL 25, 2023

1,2 Conversely, couples who open up and share financial goals and values with each other tend to have more satisfying relationships. 3 It’s no surprise then that exploring how to get partners to a place where they can freely communicate about goals and values is a point of interest for financial planners.

eMoney Advisor

MARCH 7, 2023

Stepchildren, remarriages, and ex-spouses: For the modern wealth management client with a blended family, planning to transfer wealth presents a web of complexity. Fortunately, financial professionals have tools and wealth transfer strategies that can help couples be intentional about the use of their assets in an estate plan.

eMoney Advisor

FEBRUARY 1, 2023

At the 2022 Financial Planning Association National Conference, I and fellow researchers Dr. Sonya Lutter and Dr. Megan McCoy presented research-based evidence that people who have experienced financial stress and hardship in the past are often more resilient in the face of future financial shocks.

Investment Writing

JULY 6, 2023

” Why I manage money the way I do Why I became a financial planner or an investment manager Why I changed my mind about a topic important to how I help clients Why investors should pay less attention to financial news WHO Who can you trust with your money? What is the biggest risk to your financial success?

Financial Symmetry

JUNE 18, 2025

Specialized Expertise for Life’s Transitions In addition to holding the Certified Financial Planner ( CFP® ) designation, Allison earned the Certified Financial Transitionist® (CeFT®) credential in 2022—an advanced designation focused on the emotional and psychological complexities of financial change.

XY Planning Network

DECEMBER 19, 2022

Over the past year, we've published articles written with one purpose in mind: to help independent financial advisors be successful. As 2022 comes to a close, we rounded up our top 10 most-viewed blogs published this year. 5 MIN READ.

eMoney Advisor

NOVEMBER 9, 2022

Cultural humility can help create a safe space for clients to share their most important financial information, which is a critical part of the financial planning process. The most notable shift to be aware of is the departure from the conventional financial service model and the journey to holistic planning.

Sara Grillo

MAY 23, 2022

What’s up with these “advice-only financial planners?” I am a CFA® charterholder and financial advisor marketing consultant. I am an irreverent and fun marketing consultant for financial advisors. What is an advice-only financial planner? The benefits of advice-only financial planners.

eMoney Advisor

APRIL 4, 2023

Start Estate Planning Early: It’s an important step in creating a legacy where taking the right approach and creating a specific structure can improve the likelihood of its success. Financial professionals should stress the importance of getting an early start with estate planning. Sources: 1. Cerulli Associates.

eMoney Advisor

DECEMBER 21, 2022

Goal-based financial planning entails setting and achieving individual financial goals based on a client’s aspirations, assets, and savings. Whereas cash flow-based financial planning involves a precise approach to meeting goals based on the money flowing into and out of a household every month.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content