Avoid Making These Mistakes to Safeguard Your Wealth

WiserAdvisor

JUNE 13, 2025

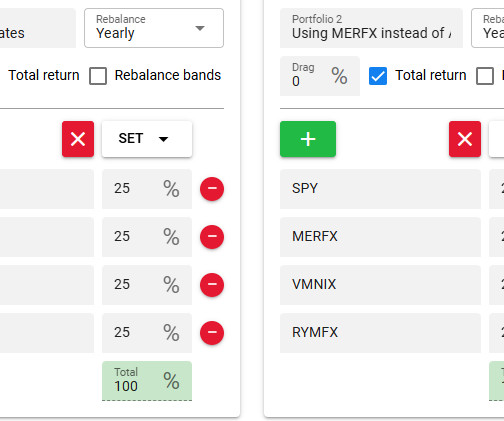

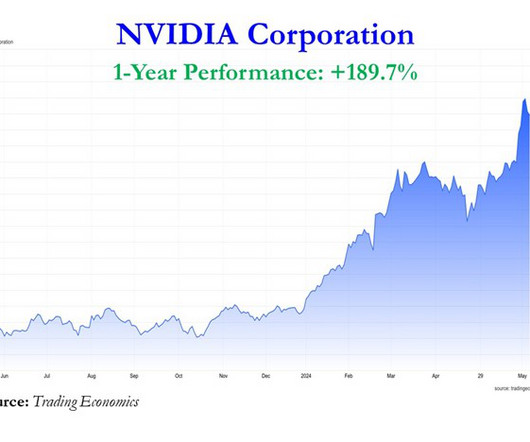

It plays a crucial role in helping people achieve financial stability, prepare for retirement, and leave a lasting legacy for their families. Here’s what to focus on: List your assets: Include properties, investments, savings, retirement accounts, insurance, and personal valuables. Look at what happened in early 2020.

Let's personalize your content