Avoid Making These Mistakes to Safeguard Your Wealth

WiserAdvisor

JUNE 13, 2025

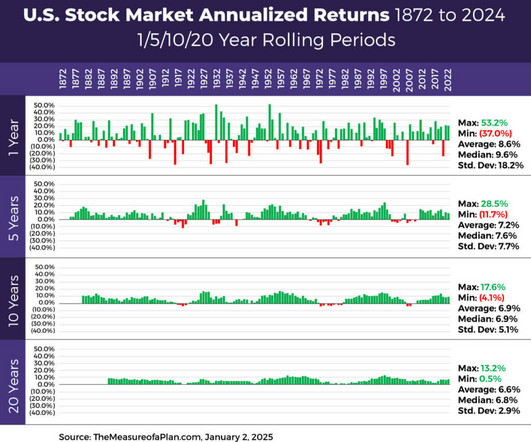

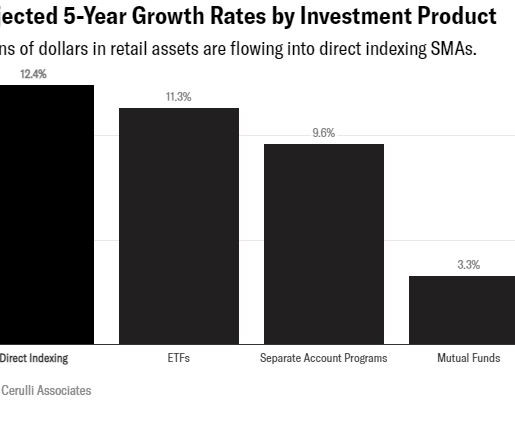

Below are some of the mistakes you should avoid making to secure your wealth: Mistake #1: Not diversifying your investments Investing too much of your money into one sector, one type of asset, or one region can expose your wealth to unnecessary risk. A good estate plan ensures your assets go where you want them to.

Let's personalize your content