Nouriel Roubini Enters The ETF Fray

Random Roger's Retirement Planning

NOVEMBER 21, 2024

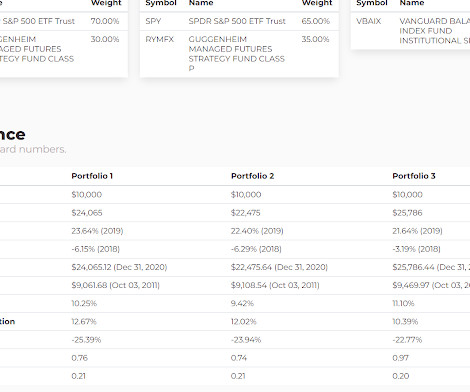

From the fund page : the goal is seeking stable returns across a variety of economic and financial market conditions, consistent with the preservation of capital. There's no fact sheet yet and while the holdings are available, the asset allocation is vague without calculating the spreadsheet yourself which I did (hopefully correctly).

Let's personalize your content