Cerulli: Gen X Presents the Next Great Opportunity for Financial Advisors

Wealth Management

JULY 2, 2025

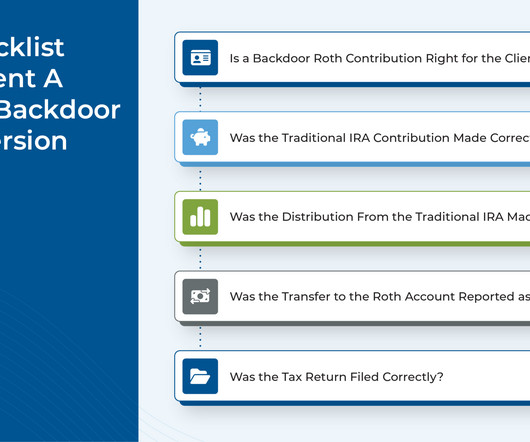

As a result, financial advisors should start honing the services Gen X members will likely benefit from the most, including retirement planning, estate and tax planning and mortgage refinancing. Between 2007 and 2010, they lost 38% of their median net worth, or $24,000, more than any other age cohort. trillion annually.

Let's personalize your content