Holistiplan’s Fee Increase Sparks Competition From FP Alpha And RightCapital (And More Of The Latest In Financial #AdvisorTech – February 2025)

Nerd's Eye View

FEBRUARY 3, 2025

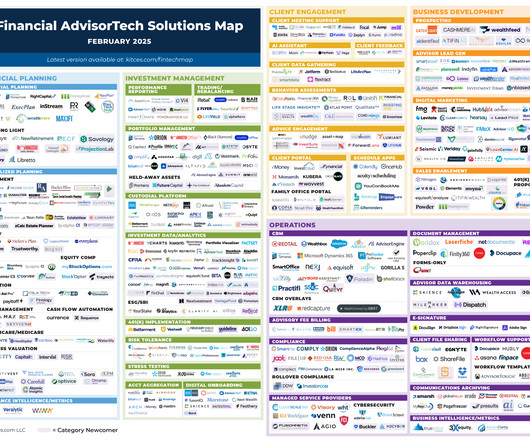

Welcome to the February 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Let's personalize your content