Big Beautiful Bill: What Estate-Planning Steps Make Sense Now?

Wealth Management

JULY 9, 2025

Explore how the One Big Beautiful Bill Act impacts estate planning across wealth levels, emphasizing flexibility and income tax strategies for advisors.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 9, 2025

Explore how the One Big Beautiful Bill Act impacts estate planning across wealth levels, emphasizing flexibility and income tax strategies for advisors.

Nerd's Eye View

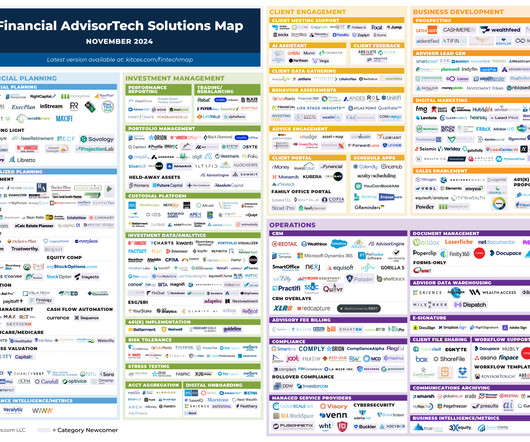

NOVEMBER 4, 2024

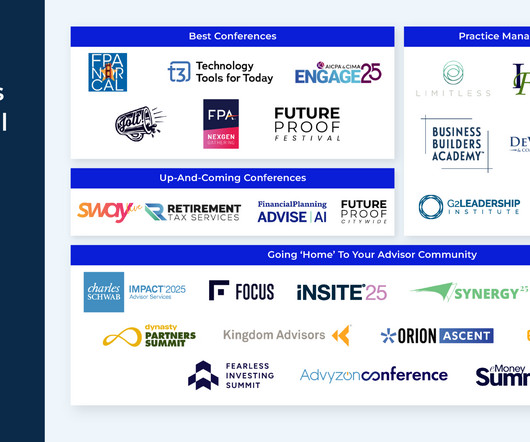

Welcome to the November 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

MAY 27, 2025

David Handler provides insights into the essential role financial advisors play in estate planning, why it's important to have an estate plan and the importance of communication and education within families about wealth management.

Wealth Management

JULY 14, 2025

New law increases transfer tax exemptions, raises SALT deduction cap, preserves TCJA rates, expands QSBS benefits and continues QBI deduction.

Wealth Management

JULY 2, 2025

Katie Greifeld July 2, 2025 2 Min Read Bloomberg photo (Bloomberg) -- Vanguard Group is planning its debut into an increasingly competitive corner of the $11.6 trillion US exchange-traded fund arena.

Wealth Management

JULY 17, 2025

based accounting firm, is taking a page from large registered investment advisors by bringing together taxes and wealth management. July 17, 2025 3 Min Read Innovative CPA Group co-founder Anthony Minopoli The Innovative CPA Group, a Shelton, Conn.-based

Wealth Management

JUNE 10, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Wealth Management EDGE 2025 Industry News & Trends Scenes From Day 1 of Wealth Management EDGE 2025 Scenes From Day 1 of Wealth Management EDGE (..)

Wealth Management

JULY 2, 2025

As a result, financial advisors should start honing the services Gen X members will likely benefit from the most, including retirement planning, estate and tax planning and mortgage refinancing. trillion annually over the next decade as part of the great wealth transfer, a new report finds. trillion annually.

Wealth Management

JUNE 26, 2025

The Diamond Podcast for Financial Advisors: 10 Ways Top Advisors Are Growing Their Businesses The Diamond Podcast for Financial Advisors: 10 Ways Top Advisors Are Growing Their Businesses A “Top 10” list of firm-level innovations and grassroots methodologies from some of the most successful advisors, teams and firms in the business.

Wealth Management

JULY 8, 2025

The move nearly doubles the number of institutional, no transaction fee (INTF) funds available through Schwab’s platform to approximately 2,000 from 58 asset managers. Institutional shares are typically only available to investors who meet certain thresholds.

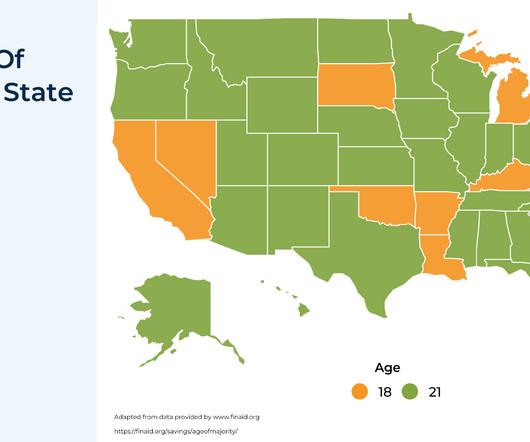

Nerd's Eye View

FEBRUARY 26, 2025

To achieve this, financial support may start at a very young age, allowing for a longer growth horizon and, in many cases, serving tax and estate planning purposes. However, once a child reaches the age of majority, they may not always be in a position to manage assets responsibly. Read More.

Wealth Management

JUNE 27, 2025

Q&A: What Was Behind Schechter’s Decision to Sell to Arax?

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo by Alex Ortolani Jul 18, 2025 1 Min Read SEC Chair Paul Atkins Alternative Investments SEC’s Atkins Says Changes to 401(k) Plans Must Be Reviewed Carefully SEC’s Atkins Says Changes to 401(k) Plans Must Be Reviewed Carefully by Nicola M. Concept of digital social marketing.

Wealth Management

JUNE 20, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all handshake hurdles M&A Understanding the Client Retention Hurdle in RIA Sales Understanding the Client Retention Hurdle in RIA Sales by Derek (..)

Wealth Management

JULY 1, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Margaret Jarocki EP Wealth Career Moves $32.6B EP Wealth Hires Integrations Head From Captrust $32.6B

Wealth Management

JUNE 26, 2025

Mason, who ran Rubicon Wealth Management, a registered investment advisor in Gladwyne, Pa., and Orchard Park Real Estate Holdings, was originally charged in January by the Securities and Exchange Commission and DOJ. Mason was also ordered to pay nearly $25 million in restitution to his victims and nearly $2.4 million to the IRS.

Wealth Management

MAY 19, 2025

Decoding covered gifts and bequests under the final regulations.

Wealth Management

JUNE 27, 2025

I was amazed by some of the findings, including that 68% of the 414 respondents are currently using or plan to adopt AI-powered tools—only 32% had no plans to do so. Q&A: What Was Behind Schechter’s Decision to Sell to Arax? expansion with significant support from some large firms.

Wealth Management

JULY 9, 2025

The list provides a picture of the places with the most growth potential compared to the competition in the wealth management profession. As you might expect, states with higher net worth households, such as New York, Connecticut and Massachusetts, are oversaturated. Click through to see where the biggest opportunities are.

Wealth Management

JULY 15, 2025

True North Expands in SF Deals & Moves: Creative Plannings Snag Hawaii RIA; $5.1B True North Expands in SF Deals & Moves: Creative Plannings Snag Hawaii RIA; $5.1B

Wealth Management

JUNE 23, 2025

For example, in early May, crypto asset manager Bitwise became the first firm to offer its assets through alternative investment platform iCapital. Investors are most interested in getting advice on risk assessment and risk management strategies from their advisors (50%). Only 13% of high-net-worth investors planned to do so.

Wealth Management

JUNE 30, 2025

Will More Wealth Advisors Gravitate to 401(k) Plans? David Bodamer , Editorial Director , WealthManagement.com June 30, 2025 2 Min Read Jerome Wilson / Alamy Stock Photo St.

Wealth Management

MAY 27, 2025

Advisor and author George Stefanou details the estate planning challenges faced by first-generation millionaires, drawing insights from boxer Leon Spinks' financial journey and legacy.

Wealth Management

JUNE 20, 2025

Davis Janowski , Senior Technology Editor, WealthManagement.com June 20, 2025 5 Min Read Dr.

Wealth Management

JULY 2, 2025

Stich , CMO, Moran Wealth Management July 2, 2025 4 Min Read Anthony Stich (right) moderating a panel on AI at Wealth Management EDGE. Joey Corsica & SpotMyPhotos Wealth management is on the edge of a profound transformation—one that won’t be defined by dashboards, APIs or UX overlays.

Wealth Management

JULY 3, 2025

The Bordeaux team, led by managing partners Tom Myers and David Murdock, came out of Brownson, Rehmus & Foxworth, a Chicago-headquartered RIA. California RIA Deals & Moves: Focus Partners Wealth Merges in $5.6B California RIA Deals & Moves: Focus Partners Wealth Merges in $5.6B

Wealth Management

JUNE 11, 2025

WealthManagement.com Staff June 11, 2025 28 Slides START SLIDESHOW Wealth Management EDGE game show The second day of Wealth Management EDGE on Wednesday included a series of firsts.

Wealth Management

JUNE 4, 2025

Billionaire David Geffen files for divorce from David Armstrong after less than two years, revealing how estate planning can safeguard wealth.

Wealth Management

JULY 1, 2025

Bay Area Firm Consilium Wealth Management joins Steward’s legacy division, which supports established teams seeking long-term succession and continuity. Bay Area Firm Steward Partners Acquires $1.1B based registered investment advisor with $1.1 billion in client assets, expanding Steward’s presence in the Bay Area.

Nerd's Eye View

JUNE 27, 2025

Also in industry news this week: While the estate tax exemption is slated to rise to $15 million in 2026 under Republican-proposed legislation, estate planning will remain a key topic for advisors and their clients across the wealth spectrum, from managing possible state estate tax exposure to ensuring that clients’ end-of-life preferences are (..)

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo by Alex Ortolani Jul 18, 2025 1 Min Read SEC Chair Paul Atkins Alternative Investments SEC’s Atkins Says Changes to 401(k) Plans Must Be Reviewed Carefully SEC’s Atkins Says Changes to 401(k) Plans Must Be Reviewed Carefully by Nicola M. Concept of digital social marketing.

Nerd's Eye View

APRIL 21, 2025

When onboarding new clients, financial advisors often use a three-meeting cadence: a Discovery Meeting to gather information, a Presentation Meeting to discuss the plan, and an Implementation Meeting to finalize it. while also setting the tone for a long-term planning relationship built on trust and deeper client engagement.

Nerd's Eye View

APRIL 21, 2025

When onboarding new clients, financial advisors often use a three-meeting cadence: a Discovery Meeting to gather information, a Presentation Meeting to discuss the plan, and an Implementation Meeting to finalize it. while also setting the tone for a long-term planning relationship built on trust and deeper client engagement.

Abnormal Returns

JUNE 16, 2025

Podcasts Michael Batnick talks with Tim White and Danny Lohrfink of Wealth.com about trends estate planning. riabiz.com) How Robinhood ($HOOD) plans to send leads to TradePMR. wsj.com) Practice management There is a big difference between being an adviser an running an advisory business.

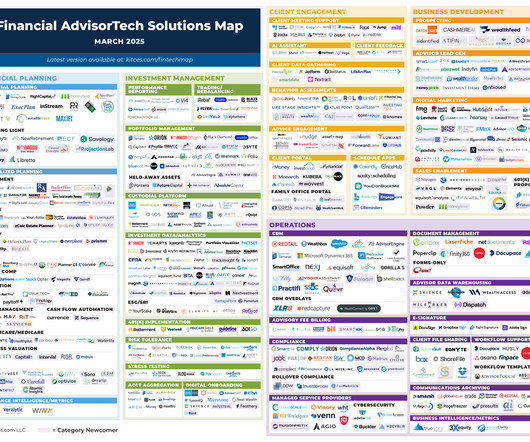

Nerd's Eye View

MARCH 3, 2025

This month's edition kicks off with the news that Morningstar Office will be shutting down in early 2026 as a part of Morningstar's ongoing effort to refocus on its core investment data and analytics business – forcing advisors currently using the tool to switch (which might be a net positive for many of those advisors who have long complained (..)

Wealth Management

JULY 2, 2025

Lothes July 2, 2025 2 Min Read Cheng Xin/Getty Images News/Getty Images In Nosirrah Management, LLC vs. AutoZone, Inc. Handler, Alison E. April 14, 2025), a district court held on summary judgment that an insider didn’t have to disgorge his profits from the sale of stock received from a grantor retained annuity trust.

Wealth Management

JULY 15, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Scott Hadley Hightower Career Moves Hightower Hires Osaic RIA Solutions Executive as Chief Advisory Officer Hightower Hires Osaic RIA Solutions (..)

Wealth Management

JULY 10, 2025

We do have a parent organization, NFP, that manages all of the infrastructure—our [data] warehouses, our Microsoft products, etc. I was leading operations at Private Ocean and took on the role of head of M&A integration for Wealthspire. This last year, I added the additional hat of head of advisory technology.

Wealth Management

JULY 1, 2025

He replaces Larry Miles, who will transition into the executive vice president of strategic partnerships role, a newly created position.

Wealth Management

JUNE 10, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Wealth Management EDGE 2025 Industry News & Trends Scenes From Day 1 of Wealth Management EDGE 2025 Scenes From Day 1 of Wealth Management EDGE (..)

Wealth Management

JUNE 25, 2025

Reporting & Portfolio Management: Orion JY: When Tucker and I bought the firm, they were already on Orion. Montis Financial: Creating a Raving Fan Experience Montis Financial: Creating a Raving Fan Experience Montis Financial CEO John Yanchek and Chief Operating Officer Judy Weeden discuss revamping the wealthstack for a 30-year-old RIA.

Nerd's Eye View

JANUARY 20, 2025

There is no shortage of written content available for financial advisors to enhance their technical skills, grow in their careers, and run more successful planning practices, from books to research studies to long-form written content. The podcasts are organized by category (e.g.,

Wealth Management

JULY 22, 2025

They’re really building out these full-service wealth management businesses that are client-centric, built on giving advisors more tools to help them grow.” That includes Creative Planning, Mariner, Savant Wealth, Cerity Partners, Hightower, Steward Partners and Corient, to name a few.

Nerd's Eye View

JULY 11, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that, amidst the growing number of RIAs it supervises, the Securities and Exchange Commission (SEC) is moving ahead with a potential plan to raise the $100 million regulatory assets under management threshold for SEC registration, (..)

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content