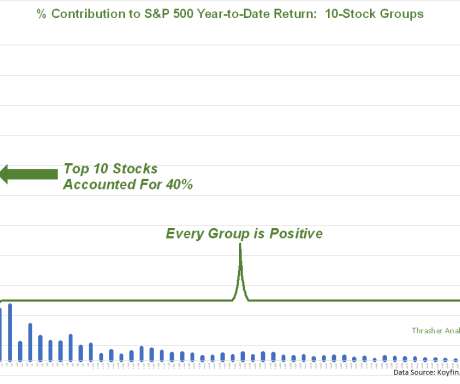

Narrowing Leadership

Andrew Thrasher

DECEMBER 13, 2021

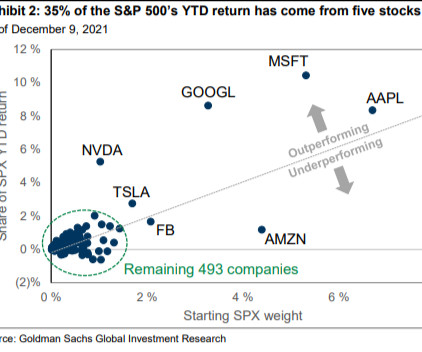

Below is an excerpt from the December 12th letter sent to subscribers of Thrasher Analytics. To learn more visit www.ThrasherAnalytics.com The topic of narrow leadership and participation has been around this year in various flavors, most notably in the summer Continue reading Narrowing Leadership → The post Narrowing Leadership first appeared on.

Let's personalize your content