This Tells You Nothing

The Irrelevant Investor

APRIL 19, 2018

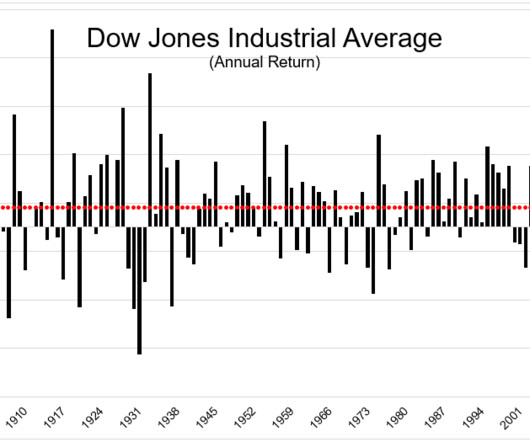

The average market strategist has a 2,943 year-end price target for the S&P 500. This is at the upper range of the typical 8 to 10% return that we expect strategists to expect every year. With an annual standard deviation of 20, an 8% average return means that stocks will return between -8% and +28% 68% of the time if they follow a normal distribution.

Let's personalize your content