How To Survive A Bear Market

The Irrelevant Investor

FEBRUARY 16, 2017

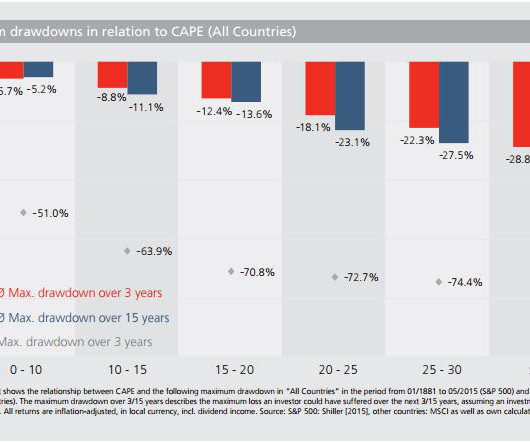

Not everybody can sit through a bear market. Sure, guys like Buffett and Munger never sell, but for the 99% of us who have emotions, we need to do something to de-risk when it looks like the world is falling apart. But what so many investors get wrong is that they don’t have a process for selling and then getting back in. The pain threshold is different for everyone, but the trigger to sell is always the same, it's overwhelming fear.

Let's personalize your content