It Feels Worse

The Irrelevant Investor

MAY 1, 2022

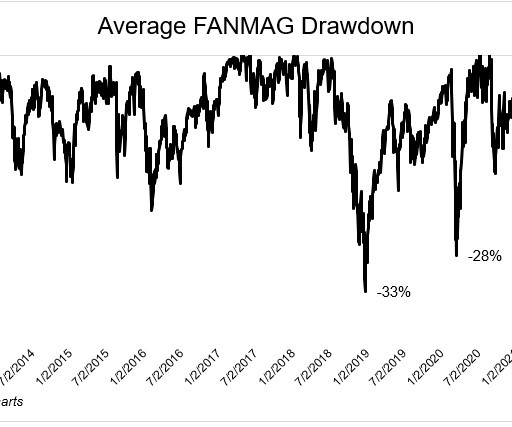

It's hard to believe that the S&P 500 is down just ~13.5% from its high. This was a common response to my post yesterday. It feels a lot worse. The average stock in the S&P 500 is in a 21.8% drawdown, so it's understandable why the first number feels off. The thing is, the index is market cap-weighted, so the average decline and the index decline rarely line up.

Let's personalize your content