Schedule for Week of February 9, 2025

Calculated Risk

FEBRUARY 8, 2025

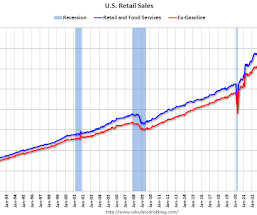

The key reports this week are January CPI and Retail sales. For manufacturing, the January Industrial Production report will be released this week. Fed Chair Powell presents the Semiannual Monetary Policy Report to the Congress on Tuesday and Wednesday. -- Monday, February 10th -- No major economic releases scheduled. -- Tuesday, February 11th -- 6:00 AM: NFIB Small Business Optimism Index for January. 10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to Congress ,

Let's personalize your content