No Pain, No Gain

Investing Caffeine

MAY 2, 2022

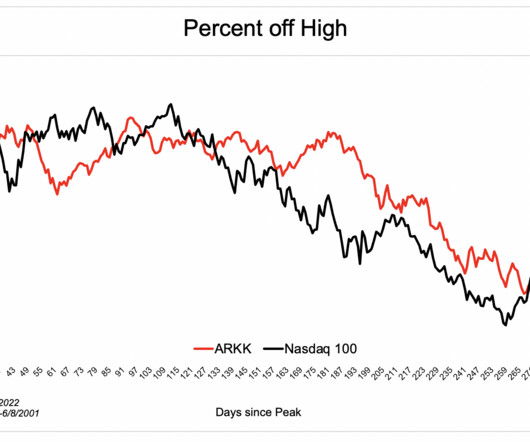

L ong-term success is rarely achieved without some suffering. In other words, you are unlikely to enjoy gains without some pain. Last month was certainly painful for stock market investors. On the heels of concerns over the Russia-Ukraine war, Federal Reserve interest rate hikes, China-COVID lockdowns, inflation/supply chain disruptions, and a potential U.S. recession, the S&P 500 index declined -8.8% for the month, while the technology-heavy NASDAQ index fell -13.3%, and the Dow Jones Indus

Let's personalize your content