A Look at One Student Housing Investor's Strategy Navigating the Current Market

Wealth Management

AUGUST 7, 2022

Campus Apartments sees now as a time to strike to achieve strong risk-adjusted returns in the student housing space.

Wealth Management

AUGUST 7, 2022

Campus Apartments sees now as a time to strike to achieve strong risk-adjusted returns in the student housing space.

Abnormal Returns

AUGUST 7, 2022

Fund management The Vanguard Total Bond Market ETF ($BND) is set to become the biggest bond ETF. (ft.com) Four big trends in the asset management have been in place for a decade. (morningstar.com) Corporate governance only works if shares actually get voted. (etftrends.com) Coinbase How Coinbase ($COIN) lost its big lead to FTX and Binance. (nytimes.com) Why the Coinbase ($COIN)-Blackrock ($BLK) agreement is a big deal.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Calculated Risk

AUGUST 7, 2022

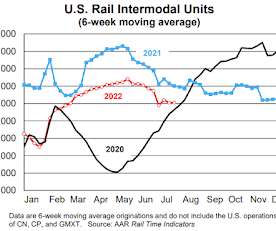

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission. Rail traffic in July was evenly balanced between commodities with carload gains and those with declines. As such, it doesn’t provide definitive evidence regarding the state of the overall economy. Moreover, the traffic category historically most highly correlated with GDP is “industrial products,” a combination of seven other categories.

Abnormal Returns

AUGUST 7, 2022

Top clicks this week Was the June bottom THE bottom? (awealthofcommonsense.com) An excerpt from "Buy This, Not That: How to Spend Your Way to Wealth and Freedom" by Sam Dogen. (getrichslowly.org) How some wealthy families avoid the trappings of wealth. (humbledollar.com) What 'The Bear' gets right about restaurants. (esquire.com) Why everyone is miserable, even though we are not in a recession.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

AUGUST 7, 2022

Weekend: • Schedule for Week of August 7, 2022 Monday: • No major economic releases scheduled. From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 11 and DOW futures are down 70 (fair value). Oil prices were down over the last week with WTI futures at $89.01 per barrel and Brent at $94.92 per barrel. A year ago, WTI was at $68, and Brent was at $71 - so WTI oil prices are up 30% year-over-year.

A Wealth of Common Sense

AUGUST 7, 2022

Paul Samuelson is credited with the quip that, “The stock market has predicted 9 out of the last 5 recessions.” You can credit Ben Carlson with a new variation on this quote: The stock market has predicted 1 out of the last 0 recessions. No one ever truly knows what the stock market is pricing in at any moment but it sure felt like it was pricing in an imminent recession in June when the market was down more t.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

oXYGen Financial

AUGUST 7, 2022

Million Dollar Round Table (MDRT)

AUGUST 7, 2022

By Jim Ruta, B.A., CFU It happens to us all. You’ve worked very hard for a long time, and you’ve made outstanding progress. All of a sudden, though, putting in more effort doesn’t mean more money anymore. Your case count levels out. Your revenue stagnates. You lose your enthusiasm. You might even slide backward. You’ve plateaued. The popular advice was “work your way through it,” as if banging your head against the wall helped your head or made a dent in the wall.

Clever Girl Finance

AUGUST 7, 2022

Do you find yourself feeling depleted, running on empty, and with almost nothing left to give? Do you always give to others first and put yourself last? If so, you are probably trying to do too much for too many people, and it's important to realize that you can't pour from an empty cup! Are you familiar with the saying? Pouring from an empty cup is exactly what you’re doing when you put everyone else’s needs ahead of your own.

Random Roger's Retirement Planning

AUGUST 7, 2022

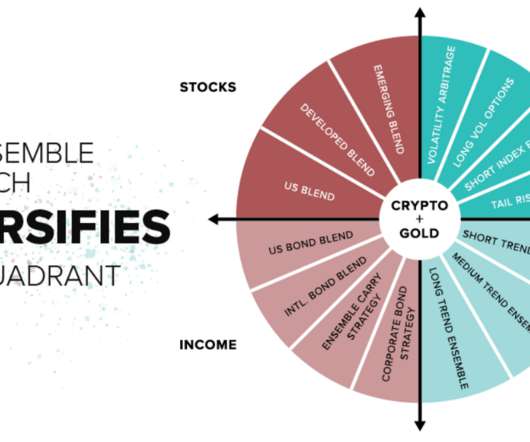

A couple of months ago we looked at The Cockroach Portfolio , a sort of all-weather portfolio that seems like it could be an attempt to update and evolve the Permanent Portfolio which allocates an equal 25% to stocks, long bonds, gold and cash. Today I wanted to try to build The Cockroach and give it a test run through portfoliovisualizer. Here's the graphic I used in the first blog post.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Trade Brains

AUGUST 7, 2022

Why did the stock market crash? A 150-year-old investment bank goes bankrupt in the most financially developed country in the world. Or someone somewhere decides to eat a bat. Most market crashes can be attributed to some or the other catalyst. But let us not fall victim to the ‘single cause fallacy. Most phenomena have multiple reasons behind them. .

The Big Picture

AUGUST 7, 2022

Change starts from the bottom up. If you’re waiting for your elected officials to go against the grain, to foment change, you’re going to wait forever for something which never comes to pass. The most important article you will read today is this: “ One Small Step for Democracy in a ‘Live Free or Die’ Town – A Cautionary tale from Croydon, N.H., where one man tried to foist a change so drastic it jolted a community out of political indifference” I’

The Big Picture

AUGUST 7, 2022

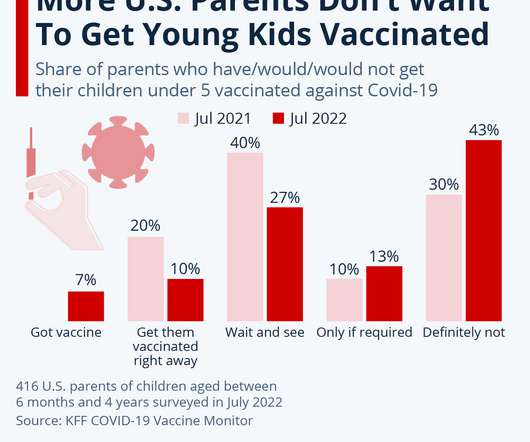

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • The Anti-Vaccine Movement’s New Frontier : A wave of parents has been radicalized by Covid-era misinformation to reject ordinary childhood immunizations — with potentially lethal consequences. ( New York Times ). • The Disastrous Record of Celebrity Crypto Endorsements : From Matt Damon’s infamous ad to Reese Witherspoon’s NFT partnership, celebrity crypto touts haven’t gone well for fan

Let's personalize your content