IRS Issues New Guidance on Retirement Plan Early Distributions

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

Wealth Management

DECEMBER 15, 2023

Act regarding individual retirement accounts, including changing when the first required minimum distribution can be made from the account, new rules for inhe The panel of experts will discuss and answer questions about the changes made by SECURE 2.0

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Chicago Financial Planner

OCTOBER 21, 2021

Saving for retirement is a major undertaking for most of us. Health savings accounts (HSA) provide another vehicle to save for retirement. Many of you have the option to enroll in high-deductible insurance plans that allow the use of a health savings account via your employer. The rising cost of healthcare in retirement .

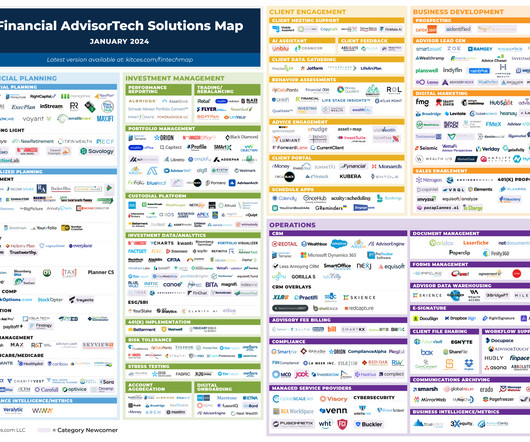

Nerd's Eye View

MARCH 28, 2025

Also in industry news this week: A recent survey indicates that younger "DIY" investors are more likely to be interested in working with a human advisor than their older counterparts, suggesting an opportunity for advisors to tap into this demographic (perhaps by setting minimum planning fees that ensure these clients can be served profitably today (..)

Getting Your Financial Ducks In A Row

APRIL 3, 2023

We’ve covered a lot of ground with regard to how various tax laws impact your retirement plans: pensions, IRAs, 403(b) and 401(k) plans. But we’ve primarily focused on the US income tax laws (the IRS) affect your plans – and there are many nuances that you need to take into account with regard to state tax laws.

Carson Wealth

MAY 29, 2025

Imagine yourself on your last ride home from work on the day you retire. It probably depends on whether you have a strong plan in place for income during your retirement years. Having a retirement planning checklist can help make this final commute the time of reflection and joy it should be.

Nerd's Eye View

JANUARY 4, 2023

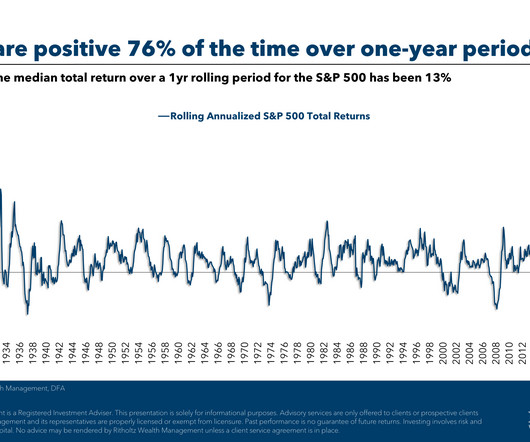

Financial advisors have a wide range of strategies at their disposal to create financial plans for their clients. And when it comes to retirement planning, one popular technique is the use of ‘guardrails’, which set an initial monthly withdrawal rate that can be later adjusted as the size of the client’s portfolio changes.

Getting Your Financial Ducks In A Row

NOVEMBER 7, 2022

When you have the bulk of your financial assets in retirement plans, you might accidentally expose yourself to some risks that you haven’t thought about… since retirement plan assets are much more likely to be impacted by changes to legislation – as we have seen in the past. No related posts.

Carson Wealth

MARCH 28, 2024

Retirement planning is a journey that generally takes decades to complete and most of us start out along the do-it-yourself path. More than likely, your first step was to enroll in an employer-provided plan such as a 401(k) or setting up an individual retirement account, also known as an IRA.

The Big Picture

FEBRUARY 27, 2023

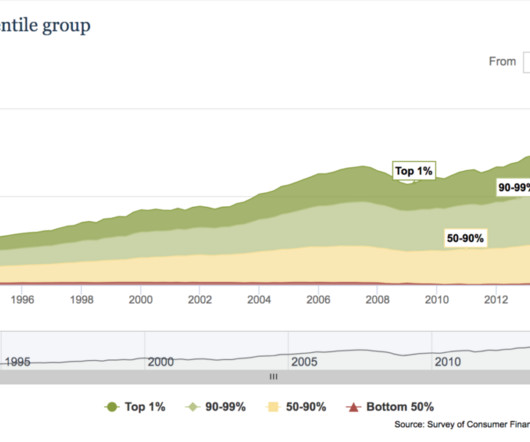

Recall last week , we were discussing thinking about the impact of retiring Baby Boomers on the equity markets and of rising rates on housing. The demographic question touches on a big issue: $6 trillion dollars in 650,000 (401k) retirement plans held by 10s of millions of Americans.

Carson Wealth

DECEMBER 20, 2024

You can move these large stock holdings to a DAF, get the tax break, and then use the money to make donations every year through your retirement. Donate Your Required Minimum Distributions If youre 73 or older, required minimum distributions (RMDs) are kicking in.

A Wealth of Common Sense

MAY 29, 2025

We also touched on questions from our audience about holding stocks in your emergency fund, the best way to pay for home renovations, how teachers should factor pensions into their retirement plans and some of my favorite fiction book series.

Darrow Wealth Management

SEPTEMBER 19, 2024

Unlike most types of retirement plans, the SEP IRA is funded by the employer. A SEP IRA (Simplified Employee Pension Individual Retirement Account) is a type of retirement plan specifically designed for self-employed individuals and small business owners. What is a SEP IRA?

Getting Your Financial Ducks In A Row

JANUARY 20, 2025

In case you don’t know what a 72t distribution is, this is shorthand for the Internal Revenue Code Section 72 part t (or IRC §72(t) for short), and the most popular provision of this code section is known as a Series of Substantially Equal Periodic Payments – SOSEPP is the acronym. Enough about the code section already.

Carson Wealth

MAY 15, 2025

Act have affected millions of Americans inheriting or leaving behind a retirement account. While required minimum distributions (RMDs) for the account owner are delayed, there is now a 10-year window for many people who inherit these accounts to take their distributions. The SECURE Act and SECURE 2.0

Nerd's Eye View

JANUARY 13, 2023

From there, we have several articles on retirement planning: The latest rules for 2023 Required Minimum Distributions from inherited retirement accounts. Why relying on Treasury Inflation-Protected Securities (TIPS) to support the bulk of retirement income needs could be risky.

Million Dollar Round Table (MDRT)

APRIL 1, 2025

understand the value of qualified charitable distributions (QCD). Not only does this money count toward your required minimum distribution (RMD), but the donation is made tax-free, and the funds dont count toward your total taxable income. Note: This only applies to U.S.-based

Nerd's Eye View

JANUARY 1, 2024

This month's edition kicks off with the news that held-away asset management platform Pontera has raised $60 million in venture capital funding as advisors increasingly seek to directly manage clients' 401(k) and other outside assets – although an ongoing investigation by Washington state regulators over whether advisors' use of Pontera violates (..)

Nerd's Eye View

DECEMBER 23, 2022

”, a series of measures that will have significant impacts on the world of retirement planning. Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congress appears poised to pass “SECURE Act 2.0”,

Getting Your Financial Ducks In A Row

FEBRUARY 10, 2025

Did you know that there is a specific order for distributions from your Roth IRA? The Internal Revenue Service has set up a group of rules to determine the order of money, by source, as it is distributed from your account. This holds for any distribution from a Roth IRA account.

Getting Your Financial Ducks In A Row

OCTOBER 17, 2022

In 1974, Congress passed the Employee Retirement Income Security Act (ERISA) that, among many other provisions, provided for the implementation of the Individual Retirement Arrangement. The Education IRA was also introduced, with features similar to the Roth IRA (non-deductible but tax-free upon qualified distribution).

Darrow Wealth Management

APRIL 21, 2025

While a Roth conversion may never make sense for some individuals, for others, early retirement years may be the best time to convert pre-tax accounts to tax-free Roth. Converting a traditional IRA to a Roth doesnt make sense unless you have cash to pay taxes without dipping into your retirement savings.

Nerd's Eye View

AUGUST 2, 2023

These include tapping employer-provided resources for adoption support, seeking out grants from charitable organizations, or, if funds are very tight, taking out loans or taking distributions from retirement plans (as the SECURE Act created a new opportunity for parents to withdraw up to $5,000 from their IRAs or employer-sponsored plans without the (..)

Nerd's Eye View

NOVEMBER 4, 2022

From there, we have several articles on investment planning: While I Bonds have received significant attention during the past year, TIPS could be an attractive alternative for many client situations. A survey showing how millionaires allocate their assets and the importance they place on the recommendations of their financial advisors.

Darrow Wealth Management

DECEMBER 23, 2022

Congress is once again poised to make sweeping changes to the retirement and tax rules in the last two weeks of the year. retirement changes. retirement changes. Raise the required minimum distribution age. In the bill, Roth 401(k) plans would also be freed of mandatory distributions starting in 2024.

Nerd's Eye View

MAY 1, 2023

Rowe Price has acquired Retiree Income, the parent company of popular retirement income planning software SSAnalyzer and Income Solver, to put its resources behind developing and distributing the company’s planning tools (albeit perhaps more to its retail and employee retirement plan clients than to advisors?).

Nerd's Eye View

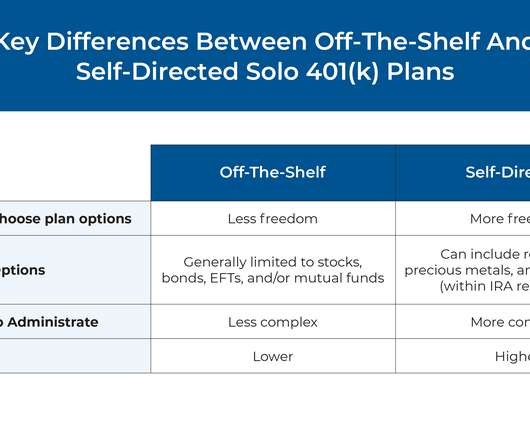

NOVEMBER 23, 2022

Among the several different types of retirement plans that are available to self-employed workers, solo 401(k) plans can offer the most flexibility and the ability to contribute the highest amount of tax-advantaged savings.

Integrity Financial Planning

OCTOBER 17, 2022

Optimizing your retirement savings takes more than just making sure your IRA isn’t at risk in this market. Know these 3 ages that can help you get the most out of your retirement accounts. At age 50, workers with certain qualified retirement plans can make annual “catch-up” contributions in addition to their normal contributions.

Darrow Wealth Management

NOVEMBER 20, 2023

If you think retirement planning moves stop at retirement, think again. Although it won’t make sense in every situation, retirement can be a unique opportunity for Roth conversions for some investors. For high earners, converting an IRA to a Roth IRA while you’re still working could be the worst time of all.

Carson Wealth

JUNE 28, 2023

Your retirement income plan may be sending up bubbles, too, whether around Social Security, retirement account distributions, taxes or somewhere else – and these holes need to be patched up right away. So, to help your retirement plan be more airtight, let’s look at a few of the common leaks.

WiserAdvisor

MAY 22, 2025

With medical inflation outpacing general inflation, ignoring healthcare in your retirement plan is a risk no one can afford. Factoring in retirement healthcare costs is a smart move. And if you are unsure where to begin, talking to a financial advisor can help you build a more personalized and realistic retirement plan.

Getting Your Financial Ducks In A Row

MARCH 6, 2023

On the flip side, there are certain things that you can’t do in a 401(k) (or other Qualified Retirement Plan) that you can ONLY do with an IRA while you’re under age 59½. Of course you would have to pay tax on the distribution, but otherwise you can take the money from your IRA for these purposes.

Nerd's Eye View

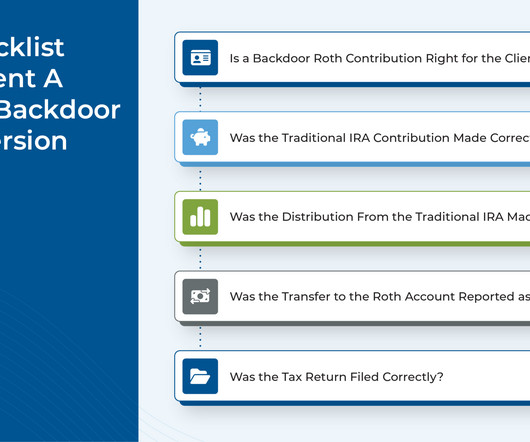

NOVEMBER 1, 2023

For instance, if the client has existing IRA dollars and/or if they plan to rollover funds from a qualified account at any point during the year, backdoor Roth conversions can be complicated significantly.

Your Richest Life

APRIL 15, 2024

Do you have a plan in place for your retirement? For many people, the extent of their retirement planning includes signing up for the plan at work – which is often more of a starting point than a comprehensive retirement plan. Some 457 plans can allow for Roth contributions and in-plan rollovers.

Carson Wealth

OCTOBER 3, 2024

Retirement is an exciting milestone—a time to leave behind the hustle and bustle of work and embrace a new chapter filled with more freedom and opportunities to enjoy life. Planning well in advance ensures that your retirement years will be financially secure, fulfilling, and less stressful than your working years.

Darrow Wealth Management

OCTOBER 24, 2022

Planning can help optimize annual RMDs depending on your goals and cash flow needs. Mandatory withdrawals from retirement accounts begin for most taxpayers at age 72. For example, what’s the best time of year to take required minimum distributions, how to reinvest it, or if you can avoid paying tax on RMDs.

Good Financial Cents

JANUARY 24, 2023

While they do share some similarities, there are enough distinct differences between the two where they can just as easily qualify as completely separate and distinct retirement plans. Either plan is an excellent choice, particularly if you’re not covered by an employer-sponsored retirement plan. Not exactly.

WiserAdvisor

OCTOBER 4, 2022

Retirement planning can be a bit complex. There are multiple factors to weigh in, right from healthcare and inflation to estate planning, business succession planning, tax planning, and more. However, the main drawback to this can be the lack of foresight regarding what and how to plan.

Harness Wealth

APRIL 16, 2025

Roth IRA conversions present a significant challenge for retirement planners: pay taxes now or later? Moving funds from traditional IRAs to Roth accounts triggers immediate taxation but promises tax-free withdrawals in retirement. The absence of required minimum distributions during the owner’s lifetime.

Park Place Financial

NOVEMBER 29, 2022

Retirement Planning 5 Ways to Catch Up on Retirement Planning Later in Life Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. Retirement is a significant investment, which is why so many financial experts recommend establishing goals and starting when still a younger adult.

Integrity Financial Planning

MAY 16, 2023

In most cases, you can’t actually keep your money in your retirement accounts forever. Even if you don’t need the money from your retirement accounts, many of them will require you to begin withdrawing from them when you are 73 years old. [1] 1] This is called a required minimum distribution (often shortened to RMD).

Getting Your Financial Ducks In A Row

FEBRUARY 24, 2025

Photo credit: jb Employers have been giving us lots of opportunities to make this decision of late: when leaving an employer, whether voluntarily or otherwise, we have the opportunity to rollover the qualified retirement plan (QRP) such as a 401(k) from the former employer to either an IRA or a new employer’s QRP.

Cordant Wealth Partners

SEPTEMBER 8, 2022

As you would expect from an outstanding organization like Microsoft, it offers a very robust 401(k) to help employees save for retirement. This article will discuss the key features of the Microsoft 401(k) plan, and after reading it, you should leave with a clear game plan of how to: Maximize the match (free money! )

Harness Wealth

JANUARY 9, 2025

Backdoor strategies are retirement contribution methods that allow individuals to bypass income limits and contribute to tax-advantaged retirement accounts. Backdoor Roth 401(k) $23,000 ($30,500 if 50+) Allows conversion of 401(k) funds to Roth, increasing tax diversification Required Minimum Distributions apply.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content