IRS Issues New Guidance on Retirement Plan Early Distributions

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

The Chicago Financial Planner

OCTOBER 21, 2021

Health savings accounts (HSA) provide another vehicle to save for retirement. Many of you have the option to enroll in high-deductible insurance plans that allow the use of a health savings account via your employer. High deductible health insurance plans . Your HSA can be another leg on the retirement planning stool.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

DECEMBER 15, 2023

Act regarding individual retirement accounts, including changing when the first required minimum distribution can be made from the account, new rules for inhe The panel of experts will discuss and answer questions about the changes made by SECURE 2.0

Carson Wealth

DECEMBER 20, 2024

While many people approach their financial planning with careful strategy, its easy to overlook the same level of intention when it comes to charitable giving. Lets explore several potentially effective financial planning tools that may help you maximize your impact and meet your philanthropic goals. government.

Nerd's Eye View

MARCH 28, 2025

Also in industry news this week: A recent survey indicates that younger "DIY" investors are more likely to be interested in working with a human advisor than their older counterparts, suggesting an opportunity for advisors to tap into this demographic (perhaps by setting minimum planning fees that ensure these clients can be served profitably today (..)

Getting Your Financial Ducks In A Row

APRIL 3, 2023

We’ve covered a lot of ground with regard to how various tax laws impact your retirement plans: pensions, IRAs, 403(b) and 401(k) plans. But we’ve primarily focused on the US income tax laws (the IRS) affect your plans – and there are many nuances that you need to take into account with regard to state tax laws.

Getting Your Financial Ducks In A Row

NOVEMBER 7, 2022

When you have the bulk of your financial assets in retirement plans, you might accidentally expose yourself to some risks that you haven’t thought about… since retirement plan assets are much more likely to be impacted by changes to legislation – as we have seen in the past. No related posts.

Carson Wealth

MAY 29, 2025

It probably depends on whether you have a strong plan in place for income during your retirement years. Having a retirement planning checklist can help make this final commute the time of reflection and joy it should be. These are staples of retirement and are great things to do to when every day is a Saturday.

Nerd's Eye View

NOVEMBER 23, 2022

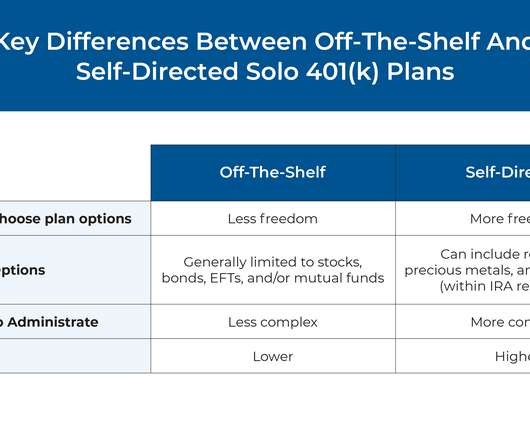

Among the several different types of retirement plans that are available to self-employed workers, solo 401(k) plans can offer the most flexibility and the ability to contribute the highest amount of tax-advantaged savings.

Carson Wealth

MARCH 28, 2024

Retirement planning is a journey that generally takes decades to complete and most of us start out along the do-it-yourself path. More than likely, your first step was to enroll in an employer-provided plan such as a 401(k) or setting up an individual retirement account, also known as an IRA.

Nerd's Eye View

AUGUST 2, 2023

Which means that financial advisors can play an important role in adoption planning – helping clients strategically plan for the costs involved in the process, including accessing tax credits that can significantly defray these expenses. At the same time, adoption can be expensive, with costs that can add up to $70,000 or more.

A Wealth of Common Sense

MAY 29, 2025

We also touched on questions from our audience about holding stocks in your emergency fund, the best way to pay for home renovations, how teachers should factor pensions into their retirement plans and some of my favorite fiction book series.

Zoe Financial

JUNE 20, 2025

For high-net-worth individuals, continuously refining your strategy over time is what keeps your plan efficient and aligned with evolving goals. At Zoe Financial, we’ve seen firsthand how proactive planning with a fiduciary advisor helps individuals protect and grow their wealth across generations.

Nerd's Eye View

JANUARY 4, 2023

Financial advisors have a wide range of strategies at their disposal to create financial plans for their clients. And when it comes to retirement planning, one popular technique is the use of ‘guardrails’, which set an initial monthly withdrawal rate that can be later adjusted as the size of the client’s portfolio changes.

Darrow Wealth Management

SEPTEMBER 19, 2024

Unlike most types of retirement plans, the SEP IRA is funded by the employer. A SEP IRA (Simplified Employee Pension Individual Retirement Account) is a type of retirement plan specifically designed for self-employed individuals and small business owners. Again, all eligible employees must be covered by the plan.

Getting Your Financial Ducks In A Row

JANUARY 20, 2025

In case you don’t know what a 72t distribution is, this is shorthand for the Internal Revenue Code Section 72 part t (or IRC §72(t) for short), and the most popular provision of this code section is known as a Series of Substantially Equal Periodic Payments – SOSEPP is the acronym. Enough about the code section already.

Nerd's Eye View

DECEMBER 23, 2022

”, a series of measures that will have significant impacts on the world of retirement planning. A review of financial planning actions, from tax-loss harvesting to charitable giving, that have a December 31 deadline.

Nerd's Eye View

JANUARY 1, 2024

This month's edition kicks off with the news that held-away asset management platform Pontera has raised $60 million in venture capital funding as advisors increasingly seek to directly manage clients' 401(k) and other outside assets – although an ongoing investigation by Washington state regulators over whether advisors' use of Pontera violates (..)

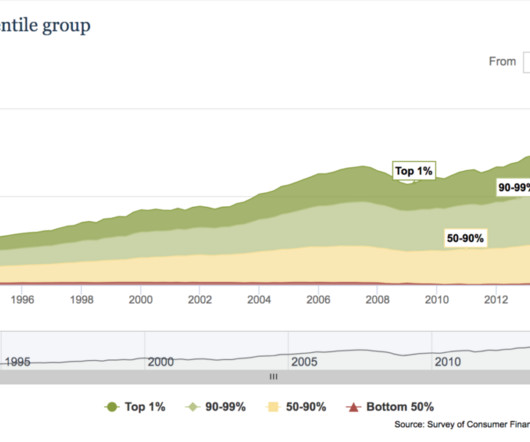

The Big Picture

FEBRUARY 27, 2023

equity valuations: “Baby-boomers’ huge flow of 401K plan contributions helped to drive equities higher; now that ~70 million Boomers are retiring, when do demographics flip this from a huge positive to a net drag?” aka The Hidden World of Failure ) (October 23, 2020) Stock Ownership : Distribution of Household Wealth in the U.S.

Nerd's Eye View

NOVEMBER 4, 2022

From there, we have several articles on investment planning: While I Bonds have received significant attention during the past year, TIPS could be an attractive alternative for many client situations. A survey showing how millionaires allocate their assets and the importance they place on the recommendations of their financial advisors.

Getting Your Financial Ducks In A Row

FEBRUARY 10, 2025

Did you know that there is a specific order for distributions from your Roth IRA? The Internal Revenue Service has set up a group of rules to determine the order of money, by source, as it is distributed from your account. This holds for any distribution from a Roth IRA account.

Nerd's Eye View

JANUARY 13, 2023

From there, we have several articles on retirement planning: The latest rules for 2023 Required Minimum Distributions from inherited retirement accounts. Why relying on Treasury Inflation-Protected Securities (TIPS) to support the bulk of retirement income needs could be risky.

WiserAdvisor

JUNE 27, 2025

Start planning early. The essence of retirement lies in reclaiming your time, on your terms and with confidence. Yet far too many professionals delay the planning process. To show you what’s possible and what’s necessary, if early retirement is something you want to pursue seriously. And the best way to do that?

Nerd's Eye View

MAY 1, 2023

Rowe Price has acquired Retiree Income, the parent company of popular retirement income planning software SSAnalyzer and Income Solver, to put its resources behind developing and distributing the company’s planning tools (albeit perhaps more to its retail and employee retirement plan clients than to advisors?).

Carson Wealth

MAY 15, 2025

Act have affected millions of Americans inheriting or leaving behind a retirement account. While required minimum distributions (RMDs) for the account owner are delayed, there is now a 10-year window for many people who inherit these accounts to take their distributions. The SECURE Act and SECURE 2.0

Million Dollar Round Table (MDRT)

APRIL 1, 2025

understand the value of qualified charitable distributions (QCD). Not only does this money count toward your required minimum distribution (RMD), but the donation is made tax-free, and the funds dont count toward your total taxable income. Note: This only applies to U.S.-based taxes.)

Nerd's Eye View

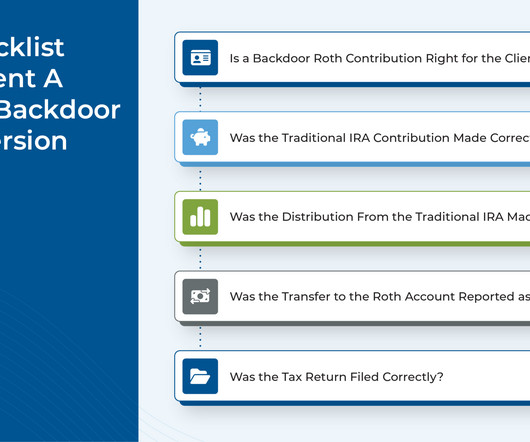

NOVEMBER 1, 2023

There are many tax planning strategies that allow financial advisors to demonstrate the ongoing value they provide to clients in exchange for the fees they charge. Part of this value is understanding the detailed nuances that make a strategy effective and implementing it correctly, avoiding issues with the IRS down the line.

Darrow Wealth Management

APRIL 21, 2025

This approach typically provides greater benefits to those who have significant assets and high taxable income in retirement. Inheritance and estate planning There are a couple ways a Roth IRA conversion can assist with estate and legacy planning. A spouse may also elect to defer RMDs if they inherit the account.

Getting Your Financial Ducks In A Row

MARCH 6, 2023

Photo credit: jb We have discussed in the past that it is usually better to rollover an old 401(k) plan from a former employer to an IRA – more flexibility in investments, (usually) lower costs, more control, etc., As long as the overall costs remain low in the plan, you might want to leave the funds there.

Carson Wealth

JUNE 28, 2023

Your retirement income plan may be sending up bubbles, too, whether around Social Security, retirement account distributions, taxes or somewhere else – and these holes need to be patched up right away. So, to help your retirement plan be more airtight, let’s look at a few of the common leaks.

Good Financial Cents

APRIL 1, 2023

Financial bloggers often portray the traditional IRA vs. the 401(k) plan as a debate, as if one plan is better than the other. In truth, they’re very different plans, and they fill very different needs. If you can, you should plan to have both. This is especially true if your 401(k) plan is fairly restrictive.

Harness Wealth

APRIL 30, 2025

Without proper planning, taxes can unexpectedly take a large bite out of the proceeds, potentially reducing financial security and the legacy. The most common exit options include mergers and acquisitions, asset sales, stock sales, and employee ownership plans.

Integrity Financial Planning

AUGUST 28, 2022

Understand the basics first, and then create an estate plan. Wills and trusts are both important estate planning tools with important differences. A will ensures property is distributed after your passing, according to your wishes, while a trust goes into effect as soon as you create it. A Will vs. a Trust.

Your Richest Life

APRIL 15, 2024

Do you have a plan in place for your retirement? For many people, the extent of their retirement planning includes signing up for the plan at work – which is often more of a starting point than a comprehensive retirement plan. Some 457 plans can allow for Roth contributions and in-plan rollovers.

WiserAdvisor

JULY 2, 2025

Without proper planning, healthcare expenses can quickly consume a significant portion of retirement savings. Without careful selection and timing, individuals risk incurring avoidable penalties and paying more than necessary for healthcare in retirement. For retirees, these trends pose a significant financial challenge.

Getting Your Financial Ducks In A Row

FEBRUARY 24, 2025

Photo credit: jb Employers have been giving us lots of opportunities to make this decision of late: when leaving an employer, whether voluntarily or otherwise, we have the opportunity to rollover the qualified retirement plan (QRP) such as a 401(k) from the former employer to either an IRA or a new employer’s QRP.

Darrow Wealth Management

OCTOBER 24, 2022

Planning can help optimize annual RMDs depending on your goals and cash flow needs. Mandatory withdrawals from retirement accounts begin for most taxpayers at age 72. For example, what’s the best time of year to take required minimum distributions, how to reinvest it, or if you can avoid paying tax on RMDs.

WiserAdvisor

MAY 22, 2025

With medical inflation outpacing general inflation, ignoring healthcare in your retirement plan is a risk no one can afford. Factoring in retirement healthcare costs is a smart move. And if you are unsure where to begin, talking to a financial advisor can help you build a more personalized and realistic retirement plan.

Darrow Wealth Management

DECEMBER 23, 2022

Some of the measures in the bill include increasing the required minimum distribution age, raising catch-up contribution limits, permitting some rollovers from 529 plans to Roth IRAs, and expanded access to employer plans. retirement changes. Raise the required minimum distribution age. The Secure Act 2.0

Harness Wealth

APRIL 16, 2025

Moving funds from traditional IRAs to Roth accounts triggers immediate taxation but promises tax-free withdrawals in retirement. The stakes became higher after the Tax Cuts and Jobs Act of 2017 eliminated recharacterizationthe ability to reverse conversions that did not work as planned.

Harness Wealth

JANUARY 9, 2025

Backdoor Roth 401(k) $23,000 ($30,500 if 50+) Allows conversion of 401(k) funds to Roth, increasing tax diversification Required Minimum Distributions apply. It also requires an individuals 401(k) plan to allow after-tax contributions and in-service withdrawals. Complex setup process.

Good Financial Cents

JANUARY 24, 2023

The Roth IRA vs traditional IRA – they’re basically the same plan, right? While they do share some similarities, there are enough distinct differences between the two where they can just as easily qualify as completely separate and distinct retirement plans. Not exactly. The most basic requirement is that you have earned income.

Integrity Financial Planning

OCTOBER 17, 2022

At age 50, workers with certain qualified retirement plans can make annual “catch-up” contributions in addition to their normal contributions. Those who are 50 or older and participate in a Simple IRA or Simple 401(k) plan can contribute up to $17,000 per year for 2022. Some 401(k) plans allow this, and others do not.

Getting Your Financial Ducks In A Row

OCTOBER 17, 2022

Two primary goals of the IRA were to provide a tax-advantaged retirement plan to employees of businesses that were unable to provide a pension plan; in addition, to provide a vehicle for preserving tax-deferred status of qualified plan assets at employment termination (rollovers). billion in the first year (1975).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content