Edelman Financial Engines Acquires $1.5B Retirement Plan Consultant

Wealth Management

DECEMBER 14, 2023

The deal with New England Pension Plans Systems is Edelman Financial Engine's largest acquisition since 2021.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 14, 2023

The deal with New England Pension Plans Systems is Edelman Financial Engine's largest acquisition since 2021.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. You deserve a comfortable retirement. If you don’t plan for your own retirement who will? I generally consider this a plan for the self-employed.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

MARCH 9, 2023

billion firm with wealth, retirement planning, and endowment and foundation businesses. In its first acquisition of the year, Captrust adds a $5.8

Nerd's Eye View

MARCH 10, 2025

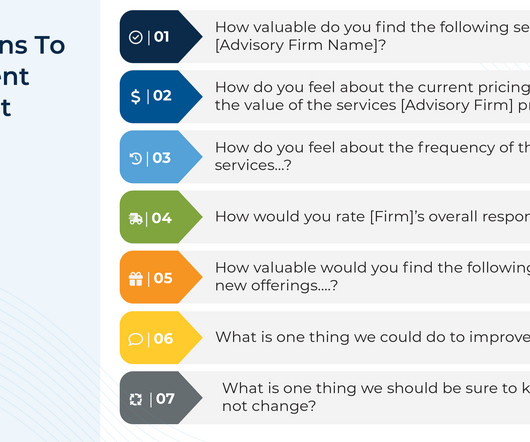

These services may range from 'standard' offerings like retirement planning to less traditional areas like credit card consulting. Financial advicers often market their comprehensive financial services as a way to differentiate themselves from other advisory firms and to stand out in the broader landscape of financial advice.

Wealth Management

SEPTEMBER 7, 2022

HUB International acquired Direct Advisors, a $600 million retirement plan consultant and third-party administrator in Latham, N.Y.

Wealth Management

APRIL 14, 2023

OneDigital acquired Huntington National Bank’s 401(k) and retirement plan business this week, while Clearstead Advisors picked up local firm CLS Consulting. The Mather Group and NewEdge Wealth both announced key hires.

Wealth Management

DECEMBER 4, 2023

AFS 401(k) Retirement Services and AFS Financial Group is a retirement plan and wealth management consulting firm with $2.3 billion in assets under advisement.

Wealth Management

JUNE 16, 2023

billion retirement plan consulting business. In RIA news this week, Hightower announced its 3rd billion-dollar-plus acquisition this month, while SageView picked up a $5.2

Carson Wealth

MAY 29, 2025

Having a retirement planning checklist can help make this final commute the time of reflection and joy it should be. While you simply cant plan for everything, having the essentials in place can give you the confidence and clarity you need to enjoy the freedom retirement can provide.

Carson Wealth

MARCH 28, 2024

Retirement planning is a journey that generally takes decades to complete and most of us start out along the do-it-yourself path. More than likely, your first step was to enroll in an employer-provided plan such as a 401(k) or setting up an individual retirement account, also known as an IRA.

Zoe Financial

JUNE 20, 2025

FAQs: Understanding the Basics How much should I contribute to my retirement plan? High earners often use multiple vehicles, like IRAs, taxable accounts, or deferred compensation plans. Always consult a qualified financial advisor or tax professional before implementing any financial strategy.

Darrow Wealth Management

SEPTEMBER 19, 2024

Unlike most types of retirement plans, the SEP IRA is funded by the employer. A SEP IRA (Simplified Employee Pension Individual Retirement Account) is a type of retirement plan specifically designed for self-employed individuals and small business owners. What is a SEP IRA?

Yardley Wealth Management

JANUARY 21, 2025

Retirement Planning Retirement planning is one area where talking to a financial planner proves particularly worthwhile. We offer personalized financial planning services tailored to your unique goals and circumstances.

The Big Picture

MARCH 6, 2023

Lawmakers are trying to restrict these investment choices in workplace retirement plans, but big fund managers are trying to give shareholders a voice. ( At Columbia, she did consulting work for numerous institutions before joining Soros Capital Management and S.A.C. A Wealth of Common Sense ) • On Wall St., Capital Advisors.

Carson Wealth

JULY 3, 2024

Consulting a tax advisor or attorney can help develop strategies for minimizing tax liability and staying compliant. Plan for Your Retirement As a small business owner, it’s essential to plan for your retirement independently since you may not have the benefit of employer-sponsored retirement plans.

NAIFA Advisor Today

MAY 12, 2025

Their appeal lies in their flexibility, tax advantages, and ability to help small business owners save more for retirement while reducing taxable income. As more clients look for impactful retirement planning strategies, understanding how cash balance plans work is more important than ever.

The Big Picture

FEBRUARY 27, 2023

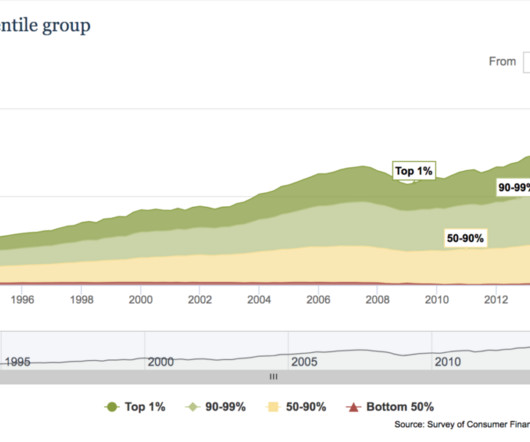

equity valuations: “Baby-boomers’ huge flow of 401K plan contributions helped to drive equities higher; now that ~70 million Boomers are retiring, when do demographics flip this from a huge positive to a net drag?” Let’s consider another question, this one on U.S.

Zoe Financial

JANUARY 27, 2025

The Five Phases of Retirement Planning Published January 29, 2025 Reading Time: 2 minutes Written by: The Zoe Team Retirement is a journey with distinct phases, each requiring its own focus and preparation. Its about striking a balance between enjoying your retirement and ensuring long-term security.

Nationwide Financial

OCTOBER 6, 2022

Key Takeaways: According to a new Nationwide Retirement Institute® survey, the overall outlook on retirement for Americans has changed significantly since 2021, as roughly one in four employees feel they are on the wrong track for retirement and fewer than six in 10 have a positive outlook on their retirement plan and financial investments.

Tobias Financial

JUNE 16, 2025

Annual reviews of tax filings, insurance policies, retirement plans, estate documents, and net worth statements support long-term clarity and preparedness. These proactive reviews can also uncover opportunities to optimize and realign your plan with your evolving priorities. It is for information and planning purposes only.

Nationwide Financial

JANUARY 10, 2023

Financial professionals, advisors and consultants can help plan sponsors understand how guaranteed lifetime income investment options may fit into their investment line-up. 2022 was a difficult year for many American retirement savers who watched markets drop and inflation dent their monthly budgets.

WiserAdvisor

NOVEMBER 14, 2023

Retirement planning is an essential aspect of financial security, especially as one transitions from a phase of regular income to relying on savings and investments. With increased life expectancy, the modern retirement plan may need to account for not only a longer life but also for the increased expectations during this phase.

Carson Wealth

JUNE 28, 2023

Your retirement income plan may be sending up bubbles, too, whether around Social Security, retirement account distributions, taxes or somewhere else – and these holes need to be patched up right away. So, to help your retirement plan be more airtight, let’s look at a few of the common leaks.

Carson Wealth

DECEMBER 8, 2023

Attorneys are telling us that 2024 is the time to review and change your estate plan as the lines may be out the door in 2025 for taxpayers wanting to make last minute changes to take advantage of the higher exemption amount. Lastly, I allocate the retirement plan contributions between Roth and Traditional 401(k) accounts.

WiserAdvisor

MAY 22, 2025

With medical inflation outpacing general inflation, ignoring healthcare in your retirement plan is a risk no one can afford. Factoring in retirement healthcare costs is a smart move. And if you are unsure where to begin, talking to a financial advisor can help you build a more personalized and realistic retirement plan.

Park Place Financial

NOVEMBER 29, 2022

Retirement Planning 5 Ways to Catch Up on Retirement Planning Later in Life Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. Retirement is a significant investment, which is why so many financial experts recommend establishing goals and starting when still a younger adult. SIMPLE 401(ks) and IRAs

WiserAdvisor

SEPTEMBER 13, 2022

The average retirement age in America is 63. However, it may still be advised to start planning your retirement as soon as you can. Retirement planning is a long process. It can take several years to understand your future needs and accumulate enough savings to prepare for a financially secure retirement.

Indigo Marketing Agency

FEBRUARY 8, 2025

You can start hosting webinars by first choosing topics that matter to your audiencethings like retirement planning, wealth preservation, or smart investment strategies. Offer a Free Consultation A free consultation is your chance to build trust through a one-on-one connection.

Tobias Financial

JUNE 15, 2025

Retirement planning is deeply personal, and for single individuals, it comes with both unique opportunities and important considerations. Whether by choice or circumstance, retiring solo means you’re in full control of your financial decisions, but you also face distinct planning challenges that require thoughtful strategy.

Sara Grillo

DECEMBER 16, 2024

Today I have Brian Williams of Northshire Consulting and were going to be talking about how financial advisors can help improve 401k plan access to the American people who are working at small businesses who currently do not offer them. What if the local baker had a 401k plan? The neighborhood laundry? The neighborhood laundry?

Carson Wealth

MARCH 14, 2024

This will allow you to maintain your tax-deferred status and continue to grow that nest egg for your retirement. If you’re not familiar with how to accomplish this consult a financial advisor. This could be your first opportunity to work with a financial advisor and learn about the financial planning process.

Envision Wealth Planning

MARCH 24, 2022

Retirement planning for women can be trickier than most people may think. Most women I talk to are more concerned about paying less in taxes today than when they retire. Many people like the idea of paying less in taxes, But how does that relate to retirement planning for women and a financially free retirement?

WiserAdvisor

SEPTEMBER 14, 2022

The average retirement age in America is 63. However, it may still be advised to start planning your retirement as soon as you can. Retirement planning is a long process. It can take several years to understand your future needs and accumulate enough savings to prepare for a financially secure retirement.

WiserAdvisor

SEPTEMBER 13, 2023

While grappling with various aspects of retirement planning, it is imperative to acknowledge a critical factor that often does not receive its due attention – longevity risk. While this is undoubtedly positive, it introduces the challenge of ensuring that your financial resources last an extended retirement period.

James Hendries

AUGUST 24, 2022

But volatile markets aren’t necessarily a negative thing, especially when it comes to retirement planning. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing. Consider the alternative—something like Japan’s “Lost Decades.”

Harness Wealth

JANUARY 9, 2025

Both the Mega Backdoor Roth IRA and Mega Backdoor Roth 401(k) allow the additional contribution of funds to retirement plans after pre-tax and Roth contribution limits have been reached. Roth IRAs are also not subject to Required Minimum Distributions (RMDs), allowing more flexibility in retirement planning.

Random Roger's Retirement Planning

JANUARY 6, 2025

Do you plan to work one way or another, consulting, part time or monetized hobby? Maybe you have very few moving parts or have many more moving parts but it is important to realize that no one's retirement plan will be done in by everything going exactly as planned. What could go wrong there?

Darrow Wealth Management

APRIL 15, 2024

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in some capacity after retiring early. A partial retirement helps with the emotional transition There are two phases of retirement planning: time and money.

Indigo Marketing Agency

JUNE 12, 2025

If your specialty is helping people nearing retirement, consider using retirement-focused publications, podcasts, or online communities where your audience is already seeking advice. Networking in spaces like local retirement planning events or online forums can also help you get in front of the people who truly need your services.

Integrity Financial Planning

SEPTEMBER 26, 2022

So, preparing for the likelihood of a pullback or recession is crucial when it comes to retirement planning. That’s why it’s more important than ever to consult a financial advisor that has your best interests in mind. Why Meet with a Financial Advisor?

Indigo Marketing Agency

MARCH 5, 2025

Having the opportunity to tell your whole story is how you eliminate all objections, indoctrinate your audience, and move them to book consult calls. Appointment-booking CTAs: Encourage attendees to schedule a free consultation. Book a Free Consultation Today and lets craft a winning event marketing strategy together!

The Chicago Financial Planner

FEBRUARY 8, 2023

You should consult with the Social Security Administration, or a tax or financial advisor who is well-versed on Social Security regarding your specific situation. Approaching retirement and want another opinion on where you stand? Your situation may differ.

Harness Wealth

APRIL 16, 2025

The fundamentals of Roth and traditional IRAs Traditional IRAs have long served as a cornerstone of retirement planning, offering immediate tax benefits through deductible contributions while deferring taxes until withdrawal. Ready to explore whether a Roth conversion aligns with your retirement strategy?

Carson Wealth

OCTOBER 24, 2024

Always consult with a local real estate expert or legal advisor who understands the nuances of foreign property ownership. Understanding the intricacies of taxes, income and residency requirements, healthcare, banking and housing will help you avoid financial pitfalls and enjoy your retirement to the fullest.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content