83(b) Election for Stock Options and Restricted Stock

Darrow Wealth Management

APRIL 23, 2025

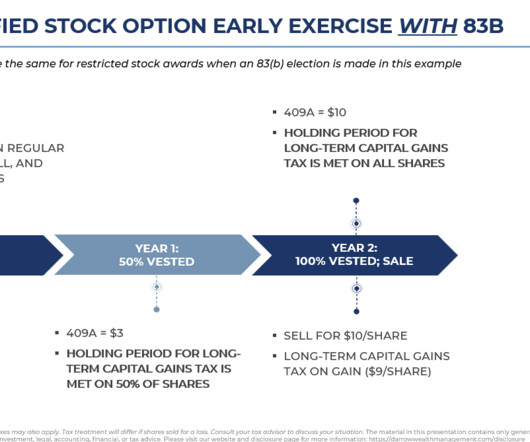

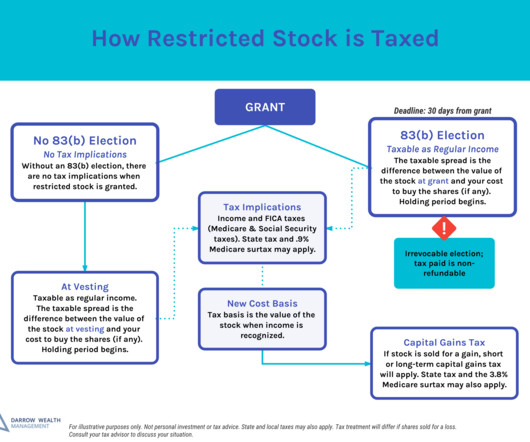

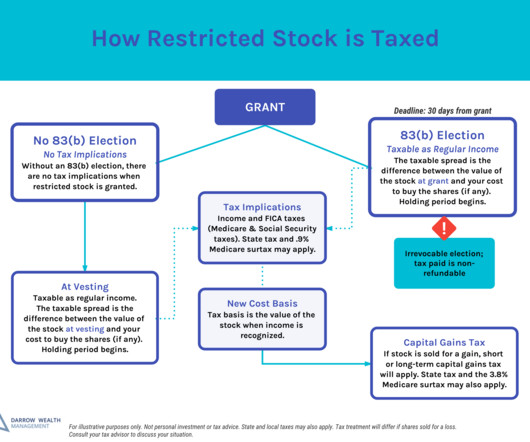

For individuals with stock-based compensation, an 83(b) election has the potential to greatly reduce taxes on stock options or restricted stock. When you purchase unvested stock compensation and make the election, you recognize the taxable gain now (if any), instead of when the shares vest. What is an 83(b) election?

Let's personalize your content