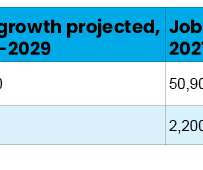

A Promising Picture for Financial Planner Job Growth

eMoney Advisor

DECEMBER 15, 2022

That’s because the advisors expected to retire control 40 percent of total industry assets, or roughly $10.4 The Financial Planning Workforce. To focus in on financial planners, we turn to the Certified Financial Planner Board of Standards’ statistics on its membership. Sources: 1.

Let's personalize your content