Why a CFP course is the smartest step in your Financial Career?

International College of Financial Planning

JULY 9, 2025

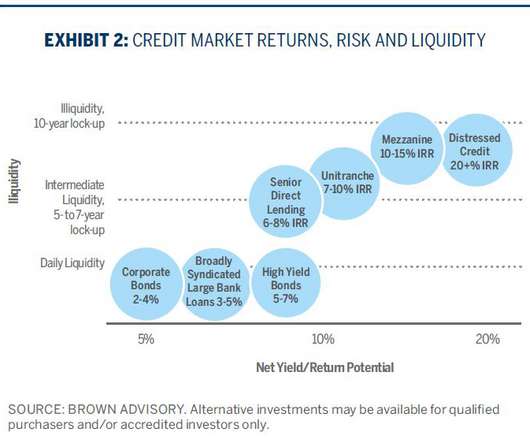

The retail investors are beginning to understand the importance of investing in structured financial products than merely locking them up in gold or real estate assets. The Fee only space or being a MFD with CFP certification will enable you to provide service of the highest quality.

Let's personalize your content