Serving Pro Bono Clients As A Busy Advisor: How Advisers Give Back Makes Volunteering Easy

Nerd's Eye View

AUGUST 15, 2022

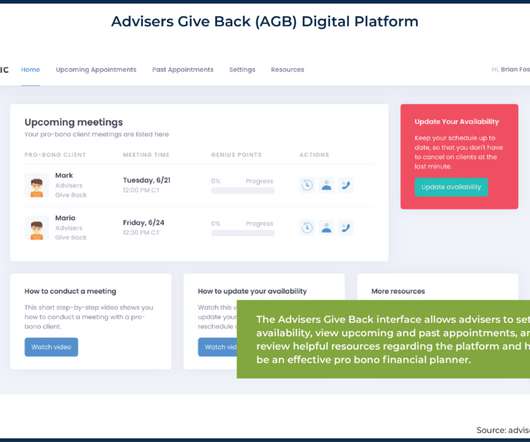

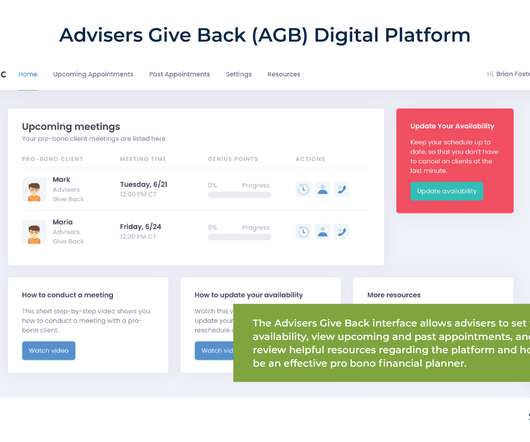

But while new fee models have allowed fee-only advisors to reach an expanding range of potential clients, there are many Americans who could benefit from professional financial advice but might not have sufficient income or assets to pay for it. law) with established pro bono programs. Read More.

Let's personalize your content