How do Financial Advisors Help in the Accumulation of Retirement Income?

WiserAdvisor

DECEMBER 15, 2023

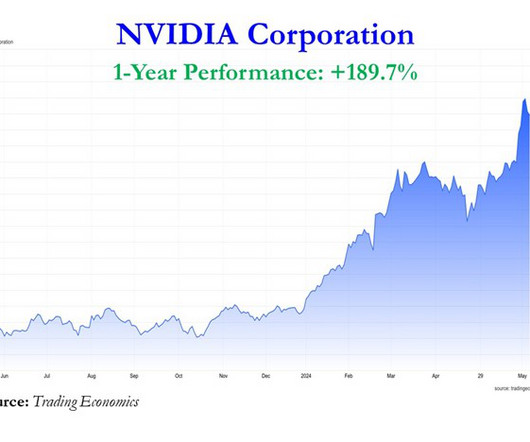

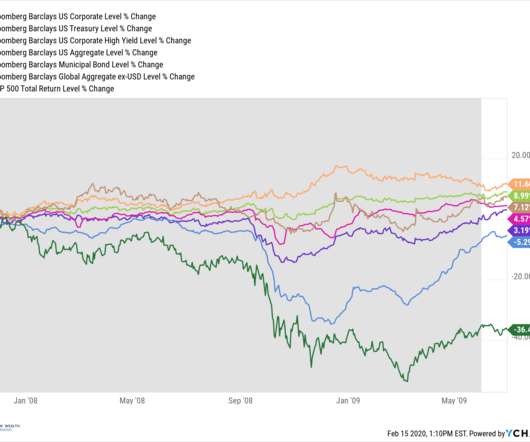

Financial advisors can offer insights into a diverse range of investment instruments, including stocks, bonds, real estate, and precious metals like gold, and align the recommendations with your risk tolerance and long-term goals. Engaging with a skilled financial advisor can empower you to manage your taxes proactively.

Let's personalize your content