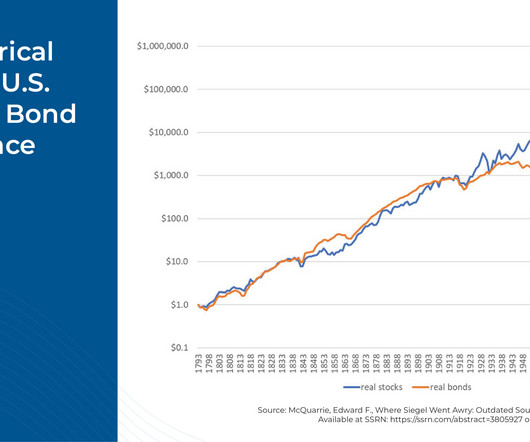

In The Long Run, Stocks Outperform Bonds… Or Do They?

Nerd's Eye View

APRIL 10, 2024

Every document that considers the facts around any particular asset class will invariably include that disclaimer, but constructing a portfolio consisting of a mix of equities, fixed income, and other assets requires investors and advicers to make some fundamental assumptions around long-term expected returns and correlations between assets.

Let's personalize your content