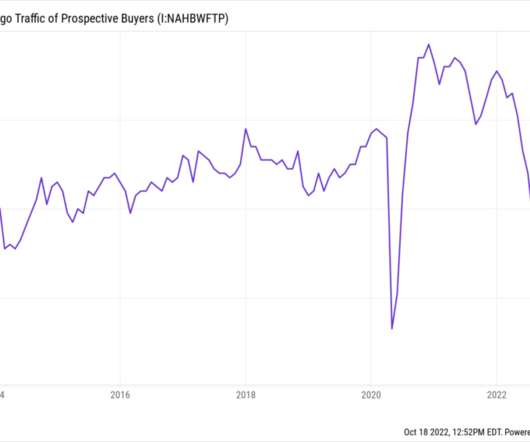

Collapse in Prospective Home Buyer Traffic

The Big Picture

OCTOBER 18, 2022

At the beginning of each quarter, I prepare a short but in-depth conference call for RWM clients. The team & I put together the most revealing and informative slides. In that half hour, I blow through ~40 slides that capture and explain what is going on. About a quarter of the October 2022 slides were focused on real estate. This is atypical. The reason we emphasized real estate this Q is that housing is very often where we see FOMC policy having its most immediate effect.

Let's personalize your content