Brandon’s Restaurants

The Big Picture

MAY 30, 2024

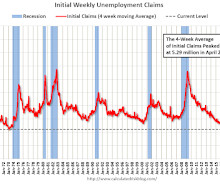

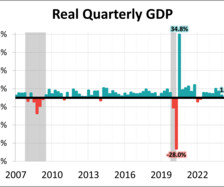

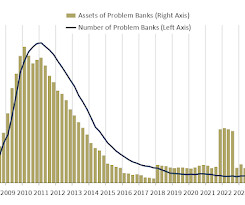

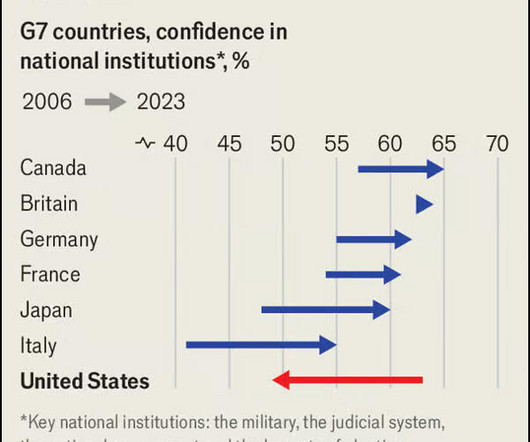

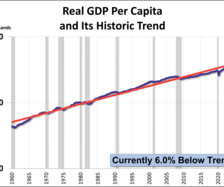

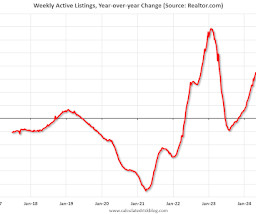

I’m just finished wrapping up the chapter in the new book1 on the dangers of denominator bias, along with related chapters on lack of context, framing, and the inherent deceptiveness of asymmetrical arguments. Simultaneously with sending those to my editor, an email arrives asking: “ If the economy is so robust, how do you explain all of these restaurant closings ?!

Let's personalize your content