The Future of Wealth Management: Transformation and Innovation

Wealth Management

JUNE 11, 2025

Brent Brodeski discusses how AI and fintech advancements are transforming wealth management, urging RIAs to adapt and seize value creation opportunities.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 11, 2025

Brent Brodeski discusses how AI and fintech advancements are transforming wealth management, urging RIAs to adapt and seize value creation opportunities.

Wealth Management

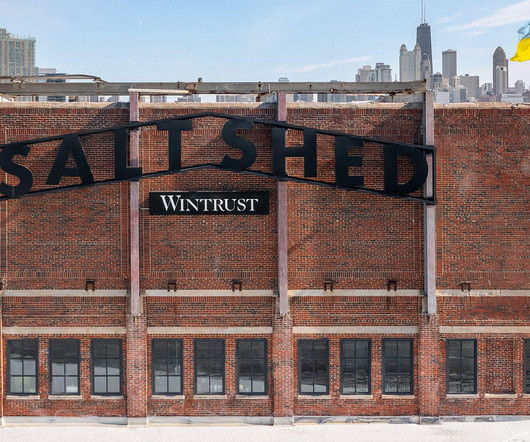

MAY 27, 2025

Ritholtz Wealth Management relocates its Chicago office to The Salt Shed, emphasizing the importance of physical workspace in attracting talent and fostering collaboration.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

JUNE 10, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Wealth Management EDGE 2025 Industry News & Trends Scenes From Day 1 of Wealth Management EDGE 2025 Scenes From Day 1 of Wealth Management EDGE (..)

Wealth Management

JUNE 10, 2025

The Wealth Management EDGE conference kicked off at The Boca Raton resort with workshop panels focused on alternative investments, artificial intelligence and high net worth clients.

Wealth Management

JULY 21, 2025

Cerity Partners' Tom Cohn shares insights on the evolution of private markets, the rise of evergreen structures and the impact of macroeconomic trends on investment decisions.

Wealth Management

JULY 17, 2025

based accounting firm, is taking a page from large registered investment advisors by bringing together taxes and wealth management. Minopoli, who is also a partner in the new RIA, had previously been the chief investment officer of a team managing a $30 billion portfolio for the Knights of Columbus Asset Advisors.

Wealth Management

JUNE 11, 2025

Allocating to Alternatives workshops at Wealth Management EDGE confirmed that evergreen funds have become the private markets investment wrapper of choice for RIAs.

Wealth Management

JUNE 20, 2025

Joey Corsica & SpotMyPhotos Fast-paced and nerve-wracking for some of the presenters, the annual WealthStack Demos did not disappoint and have become a fan favorite among attendees of the Wealth Management EDGE conference held last week at The Boca Raton resort in Boca Raton, Fla.

Wealth Management

JUNE 25, 2025

Modera Wealth Management's Tom Orecchio discusses the evolving dynamics and secrets to building a successful financial advisory firm.

Wealth Management

JULY 24, 2025

Zephyr's Ryan Nauman and Steward Partners' Jim Gold discuss the evolution of wealth management, the role of RIAs, technology and private equity in the industry, and concludes with advice for financial advisors on building sustainable practices and adapting to industry changes.

Wealth Management

JUNE 11, 2025

Rise Growth’s Joe Duran and Kitces.com’s Michael Kitces debate some of the most pressing issues in wealth management, including the need to have a brand, the value of private equity and whether culture matters.

Wealth Management

JUNE 5, 2025

CFPB petitions to vacate Section 1033 Open Banking Rule, potentially slowing innovation in wealth management and retirement sectors, affecting consumer choice.

Wealth Management

JUNE 20, 2025

Davis Janowski , Senior Technology Editor, WealthManagement.com June 20, 2025 5 Min Read Dr. Naomi Win, a behavioral finance analyst at Orion, gave a presentation entitled, “Aligning Lives and Portfolios: Meeting the Moment for Modern Investors” at Wealth Management EDGE.

Wealth Management

JUNE 16, 2025

Mercer Advisors' Don Calcagni discussed the latest investment vehicles transforming strategies, the ongoing active versus passive management debate and the nuances of private markets.

Wealth Management

JUNE 12, 2025

Wealth Management EDGE's final day featured RIA leaders discussing growth strategies and client relationships, plus a geopolitical threat simulation for advisors.

Wealth Management

JUNE 20, 2025

F2 Strategy co-founder Doug Fritz offers a mini-masterclass on how the best advisory businesses utilize technology to create efficiencies and deliver a better client experience.

Wealth Management

JUNE 17, 2025

Zach Ivey, Savant Wealth Management's CIO, discusses evolving investment landscapes, alternative allocations and educating advisors on private market liquidity at Wealth Management EDGE.

Wealth Management

JULY 16, 2025

Explore the performance, volatility and diversification benefits of private and public infrastructure investments for wealth managers and financial advisors.

Wealth Management

JULY 1, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Margaret Jarocki EP Wealth Career Moves $32.6B EP Wealth Hires Integrations Head From Captrust $32.6B The Valhalla, N.Y.

Wealth Management

JULY 2, 2025

The fund’s proposed fee is 0.22% — cheaper than any existing actively managed high-yield ETFs, data compiled by Bloomberg showed. Related: 14 Investment Must Reads for This Week (July 1, 2025) In addition to JPMorgan Asset Management, Capital Group also unveiled its first actively managed high-yield ETF last week.

Wealth Management

JUNE 12, 2025

RIA and investment leaders at Wealth Management EDGE said future-ready firms will expand revenue via adjacent services and cultivate second-generation advisors through tactics including equity stakes.

Wealth Management

JUNE 13, 2025

Shannon Rosic chats with Govinda Quish, managing director and global head of wealth management product at MSCI, to unpack how MSCI Wealth Manager transforms complex data into actionable insights for advisors.

Wealth Management

MAY 5, 2025

From the heads of mega-RIAs to solo practitioners, many wealth managers say outgoing Berkshire Hathaway CEO Warren Buffett has impacted their investing and management styles.

Wealth Management

JUNE 16, 2025

Wealthspire CEO Mike LaMena shares insights on attracting college students to finance careers, emphasizing internships, campus recruiting and work-life balance

Wealth Management

JULY 8, 2025

The move nearly doubles the number of institutional, no transaction fee (INTF) funds available through Schwab’s platform to approximately 2,000 from 58 asset managers. Related: Morningstar: Fee War Among Asset Managers Plateaus Previously, the program included about 1,200 funds from 25 managers.

Wealth Management

JUNE 26, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 Carlyle Group Alternative Investments Carlyle Makes New Retail Fund Push to Buy and Sell PE Stakes Carlyle Makes New Retail Fund Push to Buy and Sell PE Stakes by Dawn Lim Jun 26, 2025 2 Min Read Wealth (..)

Wealth Management

MAY 29, 2025

Recognize the emotions of the ongoing disruption in the wealth management world and use them as a catalyst for growth.

Wealth Management

JUNE 10, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Wealth Management EDGE 2025 Industry News & Trends Scenes From Day 1 of Wealth Management EDGE 2025 Scenes From Day 1 of Wealth Management EDGE (..)

Wealth Management

JULY 2, 2025

trillion annually over the next decade as part of the great wealth transfer, a new report finds. In addition, those millennials who fall into the ultra-high-net-worth bracket would probably benefit from advice on philanthropy and charitable giving and creating mission statements for how the family should approach its wealth.

Wealth Management

JUNE 23, 2025

For example, in early May, crypto asset manager Bitwise became the first firm to offer its assets through alternative investment platform iCapital. Investors are most interested in getting advice on risk assessment and risk management strategies from their advisors (50%).

Wealth Management

JULY 10, 2025

Tony Parr shares Parr McKnight Wealth Management Group's journey at Wells Fargo Private Client Group, and how it leveraged the firm’s independent channels to achieve a “frictionless” launch of its RIA.

Abnormal Returns

JUNE 30, 2025

kitces.com) Jess Bost and Mark Newfield talk with Matt Hobson of Eagle Wealth Management. podcasts.apple.com) Jeff Malec talks wealth management with Kevin Jamali, Senior Vice President at Farther. riabiz.com) Why Vanguard is creating two separate investment management organizations. Jeffrey Brown.

Wealth Management

MAY 21, 2025

Ryan Nauman is joined by Joe Mallen, CEO of Modelist, to discuss the evolving landscape of wealth management and the increasing importance of customizable model portfolios, transparency, proactive communication, and adaptability in modern wealth management practices.

Truemind Capital

APRIL 4, 2025

It helped me learn about the possibilities of AI use in wealth management. Many wealth management outfitsin the US have started using AI in their operations and basic level of advice. But machines can’t help you manage your emotions, which is the most important aspect of wealth creation.

Wealth Management

JUNE 27, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 The WealthStack Podcast Michael Kim AssetMark Alternative Investments The WealthStack Podcast: Unlocking Private Markets with AssetMarks Michael Kim The WealthStack Podcast: Unlocking Private Markets (..)

Wealth Management

JULY 2, 2025

Stich , CMO, Moran Wealth Management July 2, 2025 4 Min Read Anthony Stich (right) moderating a panel on AI at Wealth Management EDGE. Joey Corsica & SpotMyPhotos Wealth management is on the edge of a profound transformation—one that won’t be defined by dashboards, APIs or UX overlays.

Wealth Management

JULY 18, 2025

In 2023, he launched his own firm, Park Hill Financial Planning and Investment Management. “I False Advertising Dann Ryan, 39, founder and managing partner of New York-based Sincerus Advisory , said his first RIA job had a verbal agreement to give him a stake as a partner in 10 years. " Brennan’s response?

Yardley Wealth Management

FEBRUARY 18, 2025

The post Waterfall Wealth Management: A Strategic Approach appeared first on Yardley Wealth Management, LLC. In this article, we’ll break down the concept of waterfall wealth distribution, its benefits, and how it compares to traditional investment strategies.

Wealth Management

JULY 8, 2025

Farther’s Taylor Matthews explores how the firm is seeking to improve the advisor experience and increase the operational efficiency of wealth management firms with home-built technology.

Wealth Management

JULY 24, 2025

SEI Access adds BlackRock, KKR, and 15 other asset managers to its alternative investment platform, expanding options for advisors.

Wealth Management

JUNE 6, 2025

Jason Smith, the founder and CEO of Prosperity Capital Advisors and JL Smith Holistic Wealth Management shares insights in creating a self-sustaining, scalable financial advisory practice, emphasizing the importance of a documented financial planning process, building an ensemble practice and the cultural and operational shifts required to sustain (..)

Wealth Management

JUNE 26, 2025

Mason, who ran Rubicon Wealth Management, a registered investment advisor in Gladwyne, Pa., Mason was also ordered to pay nearly $25 million in restitution to his victims and nearly $2.4 million to the IRS. and Orchard Park Real Estate Holdings, was originally charged in January by the Securities and Exchange Commission and DOJ.

Wealth Management

JULY 1, 2025

SGH Wealth Management's Sam Huszczo discusses the emerging movement of the next generation of financial advisors, the impact of demographic shifts and the growing youth in the industry.

Wealth Management

JULY 3, 2025

California RIA Deals & Moves: Focus Partners Wealth Merges in $5.6B California RIA Deals & Moves: Focus Partners Wealth Merges in $5.6B The Bordeaux team, led by managing partners Tom Myers and David Murdock, came out of Brownson, Rehmus & Foxworth, a Chicago-headquartered RIA. a suburb of Nashville.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content