Unlocking Accessible Financial Advice The Garrett Planning Network Advantage

MainStreet Financial Planning

FEBRUARY 1, 2024

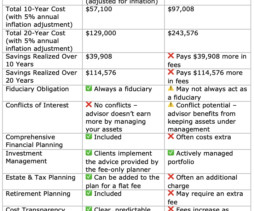

Accessible Financial Guidance for All: This is my favorite quality of being a Garrett Planning Network advisor – with fees structured as flat or on an hourly basis, MainStreet provides accessible options for individuals at every stage of their financial journey.

Let's personalize your content