Animal Spirits: The Fed’s Bazooka

The Irrelevant Investor

APRIL 10, 2020

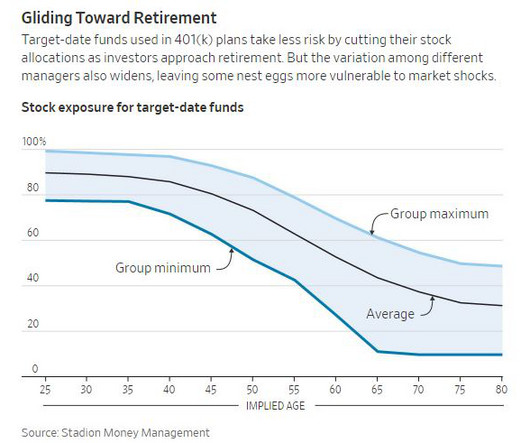

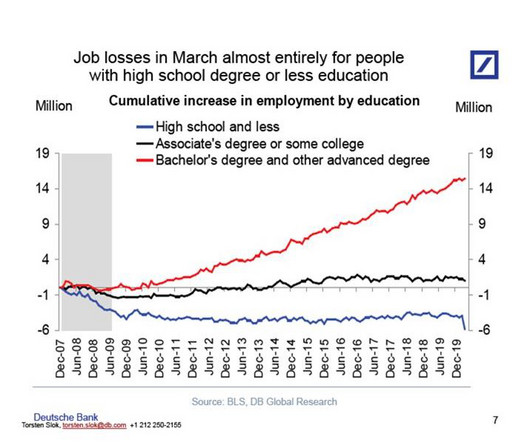

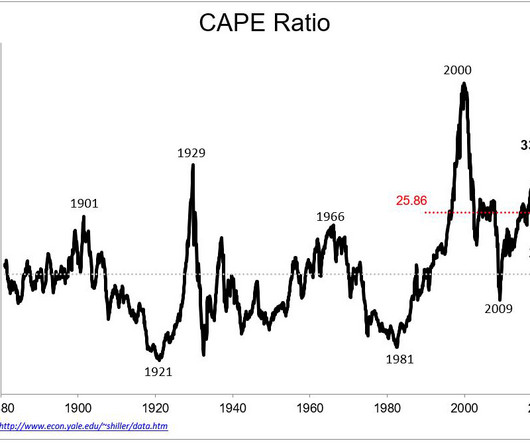

On today’s show we discuss "Just a bear market rally" How tech could help us with the virus Dispersion in target-date funds The flight to safety Spitznagel killed it in March Millennials sold stocks Nearly one-third of renters missed their April payment What does AirBnb spend so much money on? Disney plus is crushing $17 billion in cruise bonds A corporate debt reckoning is coming William Bernstein is always worth reading Listen here Recommendations The Great Depression: A Diary I am Legend Sch

Let's personalize your content