Set Your Financial Goals for 2025: A Strategic Approach to Building Your Wealth

Yardley Wealth Management

DECEMBER 17, 2024

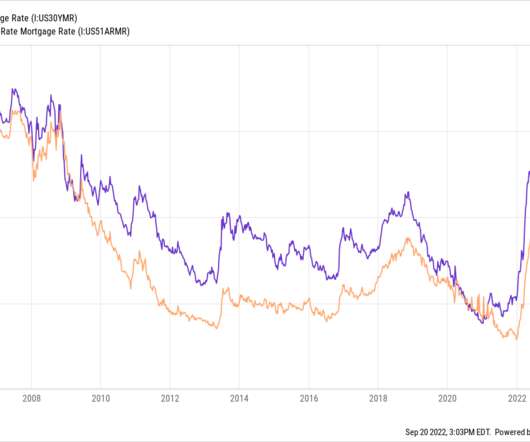

The Foundation: Emergency Funds and Debt Management The cornerstone of any solid financial plan is having a robust emergency fund. Regarding debt management, consider the current interest rate environment. While that remains important, consider diversifying your retirement strategy.

Let's personalize your content