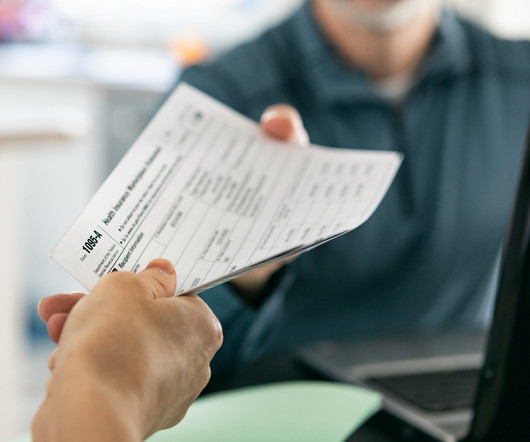

The Hidden Costs of Manual Tax Document Collection—And How to Fix It

Harness Wealth

MARCH 14, 2025

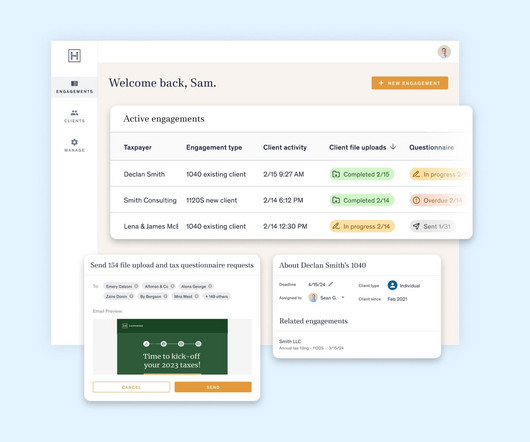

For many small tax firms, the process of collecting client tax documents can be a time-consuming and a prolonged process. Tax advisors often find themselves sending multiple reminders, following up on incomplete files, and waiting for clients to gather the necessary paperwork. Read more about Kelley Maddoxs success here.

Let's personalize your content