Serving Pro Bono Clients As A Busy Advisor: How Advisers Give Back Makes Volunteering Easy

Nerd's Eye View

AUGUST 15, 2022

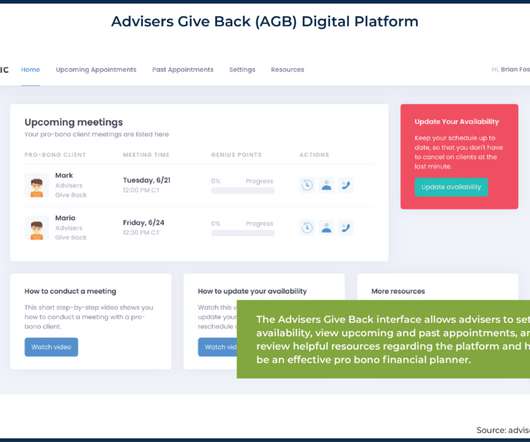

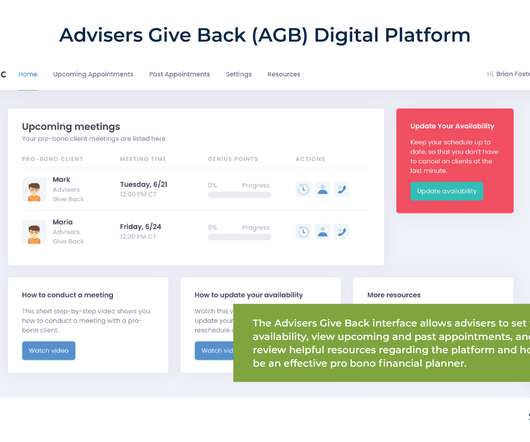

By helping clients develop financial goals, creating a financial plan, and supporting the implementation and monitoring of the plan, advisors help clients live their best lives. For instance, AGB connects with pro bono clients so advisors do not need to spend time advertising their services.

Let's personalize your content